How to Make Large Purchases Using Insurance

What counts as a big purchase for you—a house, a car, travel? Maybe a daughter’s wedding? Even though the definition of a large purchase varies from person to person, it’s likely that it will make a dent in your finances—unless you’ve got a financial strategy that is stable enough to handle whatever comes along.

We know a proven method of growing wealth used by individuals, banks, and corporations for over a century. Their secret is having comprehensive investment strategies, made up of diverse financial products that support each other—and we can help you do the same. The juicy part of this strategy is that when a large purchase comes along, you borrow money from yourself. That’s right, you are your own bank. Let us tell you how.

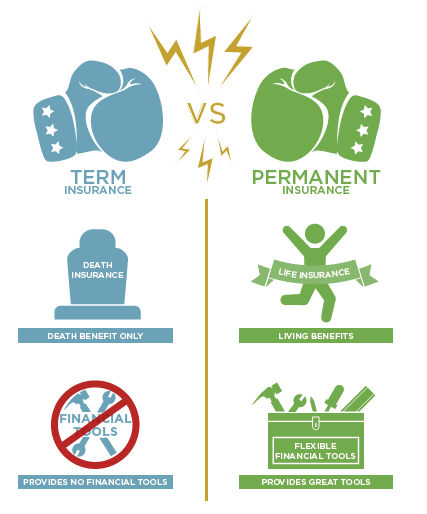

Permanent life insurance is one of the most misunderstood financial products, and has (fairly recently) sparked the attention of pop-culture financial media for significant reasons. Many corporations and banks value this asset enough that they hold tens of billions of dollars of it. (They would likely invest even more if they could—the FDIC regulates a cap on the amount of insurance they are allowed to hold.)

Banks and corporations recognize that life insurance is not necessarily “death insurance” but truly life insurance. They know how to use life insurance for its lucrative living benefits. This is not usually how life insurance is presented and sold to individuals; which is why there’s such a disconnect about the topic.

Liquidity

It turns out that the biggest reason why banks and corporations purchase tens of billions of dollars in permanent life insurance is to keep money liquid and accessible. With careful modification, you can access all of the premiums you’ve paid into the policy as cash value, but buyer beware—Without this special modification a permanent life insurance policy can take up to 16 years before all of the paid premiums are available as cash value. This detail is what gives permanent life insurance a bad reputation for not being a viable and affordable savings vehicle. Paradigm Life is one of the few qualified in the country to coach you on this option.

When you make big purchases, you know the pain of paying interest. You also know that paying in cash for everyday items like cars, vacations, furniture and more, takes your money out of circulation, and you aren’t earning interest. Here are five unconventional ideas or principles that help you get started with this strategy:

- Don’t put all of your money in the stock market.

- Put cash into your whole life policy and use it as a vehicle for your savings.

- Borrow from your policy, i.e. yourself, for major life purchases.

- Pay yourself back and recapture the interest.

- Pass your money and your strategy to future generations by teaching your family these concepts.

When you’re leveraging all of the principles, there’s real potential for one of the oldest financial products to have value in your portfolio. Remember, there is no such thing as a risky investment; only a risky investor. What separates you from risky investors is your knowledge. We want to help you learn to use cash value similarly to how banks and corporations do, as an asset that you own and control.

We want you to avoid using credit cards or bank loans to make purchases. More powerfully, we want to teach you how to recoup the lost opportunity cost associated with spending money rather than investing it. Over the course of a lifetime of big purchases, this approach could potentially put hundreds of thousands of dollars back in your pocket! It’s called the Perpetual Wealth Strategy.

We invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start building wealth.

Take advantage of this FREE resource by clicking below.

Reference: http://fortune.com/2014/08/11/how-to-protect-your-finances-from-cyber-hackers/

Reference: http://fortune.com/2014/08/11/how-to-protect-your-finances-from-cyber-hackers/