Did you make any resolutions this year? It’s not too late, especially if you’re vowing to make 2020 the year you gain financial control. But too many Americans make the wrong resolutions when it comes to money and fail to achieve their goals, year after year.

The One Thing All Financial Goals Have In Common

Financial goals need a stable foundation to succeed. The reason so many Americans fail to gain financial control every year is because they’re not putting their money in the right place. Instead, they’re exposing their wealth to too much risk.

How Risky Is Your Investment, Really?

If you think mutual funds like your 401(k) and IRA are safe places to invest, perhaps you’ve forgotten the recession in 2008. Or the current ups and downs of the stock market due to ongoing “trade wars.” These scenarios are the opposite of financial control.

While it’s smart to save for retirement, accessing money in a 401(k) or IRA before age 59 ½ subjects it to taxes and penalties that can all but erase any earned interest. If you need to withdraw money from retirement savings to pay for unexpected expenses during a market downturn, it could mean you end up with less money than if you’d never invested at all.

Before prioritizing mutual funds for retirement, you need to create a financial foundation that won’t be affected by what happens on Wall Street. In regards to trade volatility, BNY Mellon Wealth director of investment strategy Jeff Mortimer says, “If the global economy slows, you’d want a portfolio that screams safety… you want fixed income.”

So where do you invest to earn a guaranteed rate of return?

Gain Financial Control with The Hierarchy of Wealth

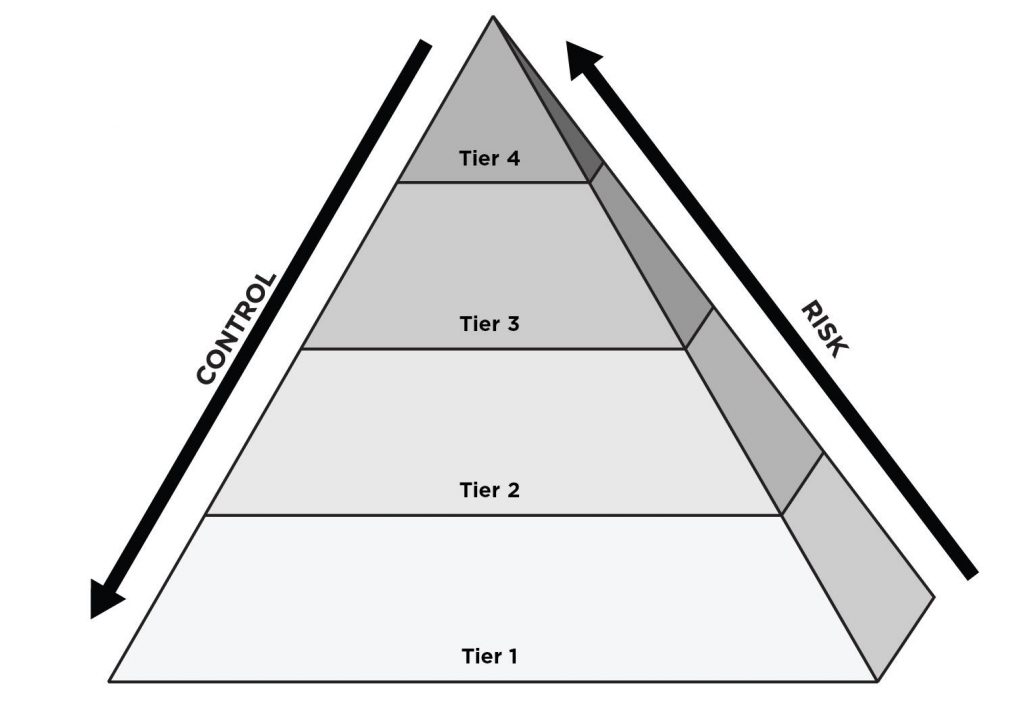

Before you resolve to do anything else in 2020, make a goal to create a financial foundation. It helps to look at financial goals as a pyramid, also known as The Hierarchy of Wealth, where you focus on wealth you control before moving on to other investments. Here’s how it works:

The Hierarchy of Wealth

Tier 4

Criteria: No guarantees, no collateral, speculative, could lose 100% of investment

Strategy: Speculative investments after at least 90% of your assets are in their respective Tiers 1, 2, and 3.

Examples: Mutual funds, stocks

Tier 3

Criteria: No guarantees, limited collateral, limited control (or controlled by a professional)

Strategy: Higher returns and higher risk, once you’ve maximized Tier 1 and Tier 2 assets.

Examples: Syndicated funds that invest in oil and gas, hard money lending, investment real estate, private lending

Tier 2

Criteria: Control, collateral, cash flow, and consistency

Strategy: Invest in personal development, your business, and hard assets you own, control, and that produce passive cash flow you don’t have to work for.

Examples: Business investments, personal real estate, personal development to make more money

Tier 1

Criteria: Guaranteed, liquid, prudent return, and control

Strategy: Put away 15-20% of earned income and establish 6-24 months of living expenses before moving to Tier 2.

Examples: The Wealth Maximization Account™, dividend-paying investments and savings

If you want to control your finances, your first goal should be to put your money in Tier 1. It’s where you have the most control and the least amount of risk. In Tier 1, you build up savings and invest to earn a fixed income, or guaranteed rate of return.

Not only does this strategy provide needed security in the event of an emergency, it gives you freedom. Say you want to make a career change or take time off to raise your family; having a Wealth Maximization Account in place means you have the financial backing you need to make these dreams a reality.

Financial Goals That You Can Keep

The approach most people take with investing ends up looking like the opposite of The Hierarchy of Wealth. The riskiest assets have become their financial foundation, and the safest and most secure assets get the least amount of consideration. When an economic change comes, like a recession, job loss, or unexpected expense, those with an inverted pyramid are wiped out.

This is the reason you’re stuck, year after year. When you don’t prioritize your financial foundation, your wealth becomes volatile, and you run the risk of constantly trying to correct things that are out of your control.

Once you’ve established a secure foundation with a Wealth Maximization Account, you can move up the Hierarchy of Wealth and create attainable financial goals knowing you have your bases covered.

At Paradigm Life we can customize a policy to fit your financial situation. Our expert Wealth Strategists are available to answer your questions and show you customized illustrations, outlining an individual plan of action to help you achieve your goals.  , no strings attached.

, no strings attached.