The Best Ways to Boost Financial Confidence for Women

History has traditionally had men in the driver’s seat when it comes to household investing. As society continues to progress, we want to change that trend and help women build the confidence to be involved with their own financial progress, regardless of their life situations. We know some women already have this confidence and skillset, and they are great mentors for others who are on the journey to financial abundance. However, statistics regarding women and finances overwhelming reveal that a barrier exists between women and investing—that barrier is confidence.

Let’s look at some reasons why it’s so important for women to build financial confidence:

- • About 80% of single-parent families are headed by females.

- • Raising a child costs about $250,000 (not including college at about $30k per year)

- • Women earn anywhere from 20 to 30% lower than men over their lifetime.

- • Women are more likely to die single than men—women generally live longer than men.

- • Investing is historically typified as masculine.

We’re not bringing this up to bring you down, but to send a message more and more women are seeking financial independence through a solid financial strategy. We want you to be prepared for whatever life brings, and we want you to have the opportunity reach your financial potential.

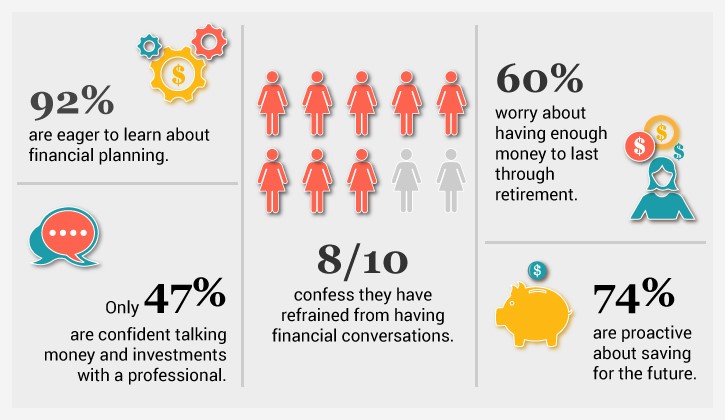

Regarding financial confidence, let’s talk about perception versus reality. Women consistently underestimate their contribution not just at work, but at home. For example women, if you calculate everything you do as if you were paying someone else to do it (yes, cleaning, cooking, chauffeuring, and more) you underestimate your financial contribution by about half! In other words, you add about twice as much value as you realize at work and at home. Also only 20 percent of women are comfortable with their financial knowledge, and that can lead to putting off important decisions like retirement planning.

“Beneath women’s reticence to talk about money lies a lack of confidence in their knowledge of financial planning and investing, “ says Kathy Murphy, president of Fidelity’s Personal Investing. “This lack of confidence is really self-imposed. Our analysis of more than 12 million investors shows that women actually demonstrated stronger saving rates than their male counterparts and enjoyed better long-term investment performance when they did engage. Unfortunately, too many women still hesitate to take control of their finances.” (Women & Money: How to Take Charge, Fidelity)

[Source: Fidelity Investments Money FIT Women Study, February 2015.]

Here are some tasks to get you started building that financial confidence muscle.

Learn the basics

Taking action to learn more about financial strategies and investing gives you power. You can start with our free eCourse, Infinite 101®. Also go online and take advantage of the vast resources available at your fingertips. Make sure to vet your information carefully to ensure it’s a source that will not steer you wrong.

Value your contributions

Your contributions are not just bringing in money. Whether you’re married or single, working or not, your contributions add up. In fact, women have their own strengths. Women are better than men at saving, prioritizing and establishing an emergency fund, getting out of debt, and maintaining a good credit score. Learn your specific strengths and leverage them.

Build a game plan and goals for a solid financial foundation

After you’ve done your homework, you’re ready to put thought into action. Your strategy should not just cover retirement, but other large expenses and purchases in your future like college, cars, and homes. Set short term and long term financial goals and how you can achieve them. You’re more likely to succeed in meeting your financial goals when you continuously aim for small targets from your steady foundation.

Focus on guarantees, certainty, and safety for your finances

Your investments should allow you access to your wealth. As you implement your strategy, you need to be able to control your money and keep it liquid (it’s called a Wealth Maximization Account, and we can show you how to set it up). We’ll talk about a way you can watch your money grow, guaranteed and borrow against it at the same time.

Create a financial team

Whether it’s your spouse, roommate, friend or a professional, find like-minded accountability partners that support your personal worth and can guide you to achieving your financial goals. Just as importantly, find mentors and teachers who can help you create your foundation and your strategy to meet your targets. Make sure these mentors are successful with their own personal financial strategies.

The good news is that women have more power and earning potential than ever before. The number of wealthy women in the U.S. is growing twice as fast as the number of wealthy men with about 45% of millionaires being women. This may be because statistically women are more successful at investing. Why? Stereotypically, women are good at creating relationships, listening, and looking at the big picture—and women are steadily closing that confidence gap.

Perpetual Wealth Strategy

When developing a strategy, women tend to take on less risk and often see the greater reward for it. A guaranteed financial product is the recommendation we have for you (and everyone else too). Accessing your cash while watching your money grow offers the best of both worlds, and we know a way to do that. The Perpetual Wealth Strategy offers all of the financial upsides without the downsides of risk of loss or trapping your money in a 401k. It involves whole life insurance for women with a paid up addition.

Growth:

Because Paradigm Life partners with mutual insurance companies the policyholder owns the company and receives a yearly return (we consider this guaranteed because in over a hundred years these companies have consistently paid returns).

Access:

When you set your policy up with a cash addition you can borrow from yourself while still getting a return on the total amount you’ve paid in. Then you pay yourself back on your own terms at a low interest rate—rinse and repeat.

Legacy:

Imagine doing all of this while ensuring that everything is in order for your family when you graduate from this life.

We want to boost the way women view their ability to grow wealth. Our mission is to help you build that wealth outside of Wall Street with certainty, liquidity, and control. We want to give you more details about the Perpetual Wealth Strategy and how it can help you get started in real estate investments. We invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.

Learn how to invest in real estate safely.