Dividend paying whole life insurance can be a multi-faceted financial tool with a variety of living benefits. Unfortunately, most people don’t understand what it is, how it works, or what makes a dividend-paying policy different from a traditional whole life policy—and this lack of understanding can translate into hundreds of thousands of lost dollars over the lifetime of a whole life insurance policy.

In this article, we’ll define dividend paying whole life insurance and show you how to use it. From growing your wealth to increasing cash flow in retirement, leaving a financial legacy or even using it to pay life insurance premiums, a dividend-paying policy provides a policyholder with options that can lead to greater financial independence.

What is Dividend Paying Whole Life Insurance?

When it comes to buying life insurance, you have a lot of options. The right policy for you and your family depends on your financial goals. For some people, simply having a death benefit in place in case they pass away unexpectedly offers sufficient coverage, so they buy term life insurance.

But there are other types of life insurance that can provide cash flow and liquidity for you and your family now, while you’re still living.

Permanent life insurance policies like whole life insurance have an additional component called cash value. It works like a high-yield savings account, earning interest over time. When you want to access funds, you have the option of withdrawing them, or borrowing them in the form of a policy loan.

Utilizing the policy loan feature of whole life insurance allows you to use any earned interest tax-free. Plus, your policy will continue to earn a guaranteed rate of return on the full value of your cash value account—regardless of your loan amount. You can essentially borrow a dollar and earn interest on it at the same time.

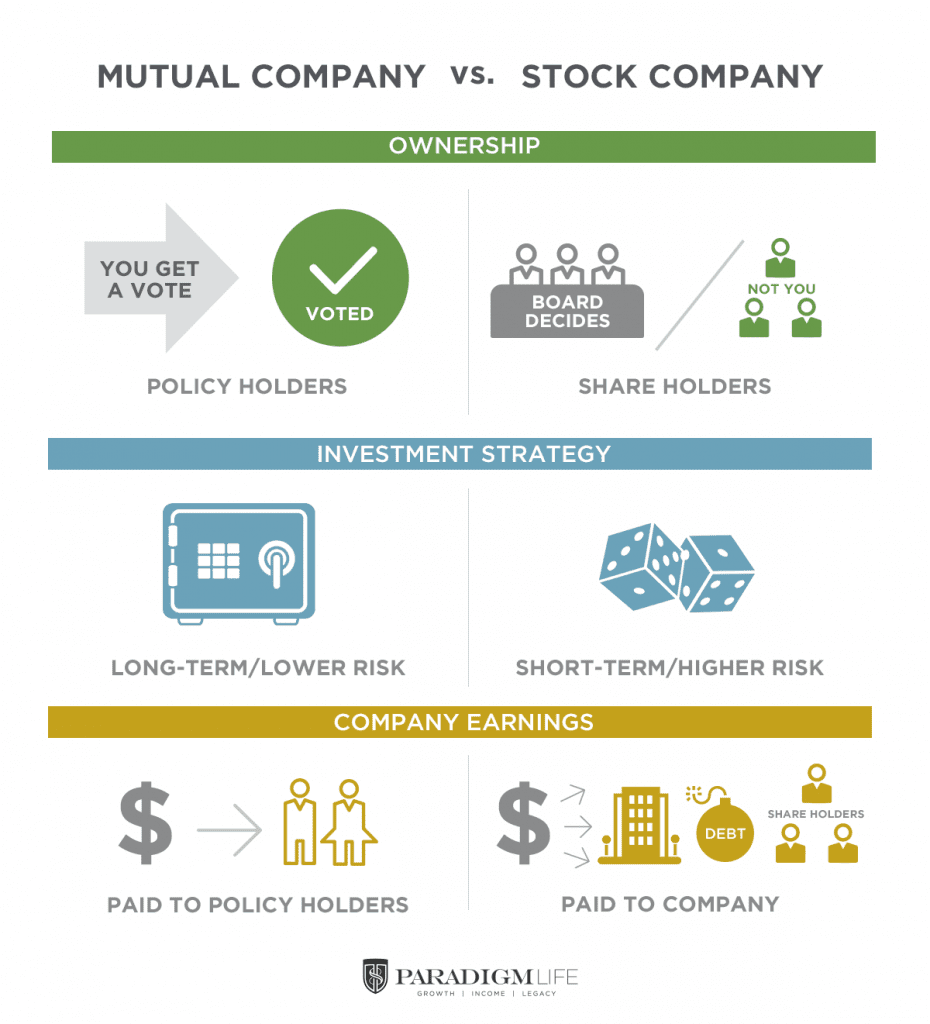

When you buy a whole life insurance policy, you have options as to what type of insurance company you purchase it from—a stock-based company or a mutual company. Here’s the difference:

With a stock-based life insurance company, a board of directors makes decisions as to what stocks and markets the company will invest in and how its profits will be distributed (spoiler alert: they are usually not shared with policyholders).

A mutual life insurance company, on the other hand, shares its profits with you in the form of dividends. Your policy is participating in the profit sharing. Hence, the alternative name for dividend paying whole life insurance: participating whole life insurance. Think of it like banking with a traditional bank vs. a credit union. With a credit union, you own a portion and are paid dividends based on the amount in your account.

When you open a whole life insurance policy with a mutual insurance company, you earn dividends on a regular basis, in addition to your guaranteed rate of return. Although dividends are not guaranteed, the top-rated mutual insurance companies we work with at Paradigm Life have paid out dividends consistently for over 100 years, including through economic crises like the Great Depression, Great Recession, and COVID-19.

Together, your guaranteed rate of return and non-guaranteed dividends in a dividend paying whole life insurance policy work to increase your overall cash value and grow your wealth faster than with a whole life insurance policy underwritten by a stock-based insurance company.

How Are Whole Life Insurance Dividends Calculated?

Dividends reflect a mutual insurance company’s profits over a predetermined period. Profits include funds from interest and investment returns, as well as the number of new policies the company sold. Your share of the payout depends on how much you’ve paid into your policy.

Example: If your policy has a value of $100,000 and your mutual insurance company offers a 5% dividend, your annual dividend would be $5,000. If, in the following year, your payments increased the value of the policy to $120,000, your annual dividend that year would be $6,000.

When considering top mutual insurance companies Guardian, Penn Mutual, Lafayette Life, and MassMutual, the average dividend payout for 2021 is estimated to be 5.65%.

How Are Whole Life Insurance Dividends Used?

Dividends earned from a mutually-owned whole life insurance company can be used in one of four ways:

- They can be added back into your policy

- They can be distributed as cash or a check to you, the policyholder

- They can be used to pay or offset the cost of future premium payments

- They can be used to purchase paid-up additions

Adding Dividends Back Into Your Policy

By choosing to have your dividends placed back into your policy, they can earn interest based on your insurer’s guaranteed rate of return, just like the rest of your cash value. This option helps your dividends work even harder to earn money for you and rapidly grow the cash value of your policy.

Distributing Dividends via Check

Taking a check from your insurance company is an easy and often tax-free way to increase cash flow. Many financial experts recommend reinvesting dividend payments to maximize your returns or using them to build up an emergency cash reserve.

Paying Premiums With Dividends

If your dividend payment is sufficiently large enough, you can use it to pay your policy premium. You can also use dividends to pay partial premiums, thereby reducing your payment amount.

Dividends tend to increase over time, which means once your policy begins earning large enough dividends that they cover your premium, you will likely enjoy a “self-paying” policy for most years moving forward. That said, dividends are not guaranteed and can fluctuate, so it’s important to meet with your Wealth Strategist or insurance agent on an annual basis to make sure your policy isn’t at risk.

Purchasing Paid-Up Additions

A paid-up additions rider is a type of supplemental insurance that helps your policy grow wealth quicker than other types of permanent life insurance. It’s only offered with whole life insurance policies and allows you to “overfund” or “front-load” your policy for rapid growth of cash value (it also exponentially increases your death benefit).

Paid-up additions life insurance, like its name implies, is immediately “paid-up” at the time of purchase (in other words, it doesn’t increase your premium payments in subsequent periods) and immediately contributes to your policy’s cash value.

Remember, the faster your cash value accumulates in a dividend paying whole life insurance policy, the greater total dividends you may earn over time (and greater interest payments from your insurance company).

By using dividends to purchase more paid-up additions insurance, you supercharge your whole life insurance policy to maximize tax-advantaged growth, liquidity, and cash flow. It’s a self-perpetuating growth cycle and a key component to the infinite banking concept.

How Are Whole Life Insurance Dividends Taxed?

Dividends are typically given favorable tax treatment by the IRS because the IRS considers them a refund/return of premiums paid. The IRS sees dividends as premium overpayments that are returned to you, the policyholder, and are considered tax-free wealth up to the policy’s basis (the amount paid into the policy).

Dividends earned on funds from premium payments aren’t taxable, but dividends earned on funds from investment gains may be. To avoid taxation, you can access these dividends in the form of tax-free policy loans.

Policy Loans, Loan Interest & Dividends

When you take out a policy loan, your insurer will charge you interest and you determine the payback terms. Utilizing dividend paying whole life insurance is key in helping your policy experience continued growth in spite of paying loan interest. Dividend payments, plus your guaranteed rate of return, work together to offset a loan interest rate and help your policy’s value increase while you still have loans outstanding.

Example: You have $100,000 in cash value in your dividend paying whole life insurance policy. You take out a $50,000 policy loan to fund your child’s college tuition. Your insurance company charges an interest rate of 7%. Assuming you pay back the loan with only one interest payment, your loan costs you $3,500 ($50,000 at 7% = $3,500).

Meanwhile, the cash value of your policy earns a guaranteed 5% rate of return, plus non-guaranteed (but historically paid) dividends at a rate of 5%. Since your rate of return and dividends are calculated on the total value of your policy (regardless of outstanding loans), you receive 5% of $100,000 in returns ($5,000) plus another 5% in dividends ($5,000), for a total return of $10,000.*

When you subtract your loan interest, you still come out ahead by $6,500. Even without dividends, your policy’s value continues to grow, but you can see how dividends increase this growth and continue to do so, compounding over time.

*Note: Direct-recognition policies do not calculate dividends with outstanding policy loans the same way non-direct recognition policies do.

Choosing the Best Life Insurance Policy

As you can see, choosing a dividend paying whole life insurance policy comes with a variety of living benefits that can be used to rapidly grow your wealth. This type of policy offers flexibility and can be customized to fit your needs and your family’s needs, regardless of your financial goals.

To learn more, or to see a dividend paying whole life insurance illustration that is customized to your budget,  . With over 14 years of experience, our primary goal is to educate our clients and help them utilize proven strategies for financial independence.

. With over 14 years of experience, our primary goal is to educate our clients and help them utilize proven strategies for financial independence.

Read More: Check out our client case studies to explore examples of how dividends help grow wealth and see what a difference they make over the lifetime of an insurance policy.