The paid-up additions (PUA) rider is a unique additional insurance feature that is available to you when you buy whole life insurance. To understand how a PUA rider works, let’s first talk about what riders are and how they compliment an insurance policy.

Key Takeaways

- There are many types of life insurance riders, which offer increased benefits and protection, often for an additional fee. The benefit of a paid-up additions rider is more cash value in your insurance policy and faster growth from dividends and guaranteed interest payments.

- Paid-up additions can be structured in a variety of ways:

- Accelerated 7-pay PUA for fastest growth and highest earnings

- Enhanced PUA over a longer number of years

- A 1035 Exchange, where paid-up additions are purchased in a tax-advantaged lump sum using funds from another insurance policy

- A Paradigm Life Wealth Strategist can help you determine the best PUA rider and structure for your unique financial goals; consultations are done virtually and are always free.

What is a Life Insurance Rider?

Life insurance riders are additional forms of insurance you can add to your policy that offer increased benefits and protection. Some insurance riders are free, others you pay for. The riders you pay for are typically added into the cost of your annual premium. Think of life insurance riders like your cable bill; some channels are included for no extra charge, but HBO will cost you extra. (Unlike your cable bill, your premiums won’t go up!)

Types of Life Insurance Riders

You individual insurance carrier might have a slightly different name for their particular product, but the 10 most common types of life insurance riders are:

- Paid-Up Additions Rider (PUA)

- Pay additional premiums in the early years of your policy for faster growth of cash value and greater returns

- Usually costs extra

- Guaranteed Insurability Rider

- Add additional coverage at a later date, within a specified term, without an additional medical exam

- Usually costs extra

- Terminal Illness Rider/Accelerated Death Benefit Rider

- Receive a portion of your death benefit while you’re still living if you’re diagnosed with a terminal illness

- Usually is included for free

- Chronic Illness Rider

- Receive a portion of your death benefit while you’re still living if you’re diagnosed with a chronic illness’

- Usually is included for free

- Same-Insured Term Rider/Flexible Protection Rider

- Adds term insurance to a whole life insurance policy for a lower cost, increasing the death benefit during the specified term

- Usually costs extra

- Waiver of Premium for Disability Rider

- Suspends premium payments if you become disabled, but still earn interest as though you were paying your premium

- Usually costs extra

- Long-Term Care Rider

- Covers long-term care needs, like nursing homes or hospice

- Usually costs extra

- Convertible Term Insurance Rider

- Allows you to convert a term insurance policy into a permanent insurance policy without an additional medical exam, within a specified term

- Usually costs extra

- Spouse/Child Insurance Rider

- Provides additional benefit for death of a specified family member

- Usually costs extra

- Accidental Death Benefit Rider

- Provides additional benefit to your beneficiary if your death is deemed an accident

- Usually is included for free

Depending on the type of insurance you buy, your family’s needs, and your financial goals, a Paradigm Life Wealth Strategist can help you choose the right insurance riders for your policy.

Paid-Up Additions (PUA) & Cash Value Insurance

To fully understand the benefit of a PUA rider, you must first understand one of the most attractive features in owning whole life insurance—the cash value.

When you pay premiums into a whole life insurance policy, a portion of that money goes toward your death benefit. But whole life offers living benefits too. One of those benefits is cash value. The portion of your premium not contributing to your policy’s death benefit goes toward a cash value account, similar to a high-interest savings account or CD.

With typically structured whole life insurance, the main focus is to get you the highest death benefit you can afford to provide for your family after you’re gone. In this case, the cash value of your policy grows very slowly. Because you earn a guaranteed interest rate and non-guaranteed dividends on whole life insurance policies backed by mutual insurance companies, less cash value means less of a return on your dollar.

When you structure a whole life policy to be your own bank, however, the main focus is to get you the most cash value in the shortest amount of time. Increasing the value of your policy by front-loading it in the early years increases your earnings from guaranteed interest and non-guaranteed dividends. More cash value equates to more money in your bank.

To enhance the living benefit of life insurance, a lot of policy owners choose to add a paid-up additions rider to enrich the cash value of their policy and increase the overall policy growth.

The Policy Loan

The cash value in your policy provides liquidity for anything you decide to use it for. The majority of Paradigm Life clients use their cash value for retirement, to fund real estate investments, pay down credit card debt, cover business expenses, buy cars, cover the cost of college tuition, or even to pay premiums on additional insurance policies. There is no limit to what you can use your cash value for.

In most cases, you’ll use your cash value via a policy loan. When you take out a policy loan, you’re borrowing your own money. Part of this money is from the premiums you’ve paid into your policy and part of it is from the interest and dividends you’ve earned. Your mutual insurance company will charge you a low interest rate to borrow this money, but they’ll continue to pay you interest and dividends on the full value of your policy. This means you’ll earn interest on yourself even as your dollars are put toward other expenses.

You choose the payback terms of your policy loan, and you don’t need bank or credit approval to use your money. This is why owning whole life insurance makes you your own banker. The money you borrow is also tax free. Any cash value and subsequent interest not paid back before you pass away will be deducted from your death benefit, and the remainder will go to your beneficiary—tax-free.

The PUA Rider

Paid-up additions riders can only be purchased separately from your policy, and are considered additional insurance. You typically purchase a PUA rider at the same time you purchase your whole life insurance policy, but it’s not part of the “basic package”. You’ll owe the insurance company an annual dollar amount for your whole life insurance premium, and a separate annual dollar amout for your PUA rider.

It is possible to add a PUA rider to an existing policy, but eligibility will depend on the insurance company, your age, and your health. Sometimes no additional medical underwriting is required, making paid-up additions an excellent feature for those whose health has declined since they purchased their original policy. If you have an existing whole life policy and are curious about adding paid-up additions now,  .

.

At some point in your policy, you can use your dividends to purchase paid-up additions (which then earn their own dividends). If you opt for a PUA rider at the same time you open your whole life insurance policy, your dividends will need to accumulate, so they will go toward your paid-up additions in later years. If you’re eligible to add a PUA rider to an existing policy, your existing dividends can be used to purchase your paid up addition.

A PUA rider has additional options for how it is paid. Most insurance companies require a minimum annual payment to keep your paid-up additions insurance, but you can contribute up to a maximum allowance for faster growth. The reason for putting a cap on your premium is to ensure it doesn’t become too cash heavy. The IRS has deemed insurance policies with a disproportionate cash value to death benefit ratio can no longer receive tax advantages. The policy becomes a Modified Endowment Contract (MEC) and is subject to additional taxation.

An Insurance Policy Inside of an Insurance Policy

Although they are usually purchased at the same time, and outlined together in the same policy illustrations, a PUA rider is essentially its own insurance policy. You can withdraw paid-up additions from your policy without a policy loan, and your PUA rider carries its own death benefit.

Paid-up additions intrinsically have their own cash value and death benefit from day one. It provides the best of both worlds and jumpstarts your whole life insurance policy, meaning more living benefits for you and a greater death benefit for your family.

In the next section, we’ll show how paid up addition riders are illustrated by insurance companies.

PUA Rider Examples

The following examples show how different clients use a PUA rider to maximize their cash value in a whole life policy. For more details, visit the Case Study page.

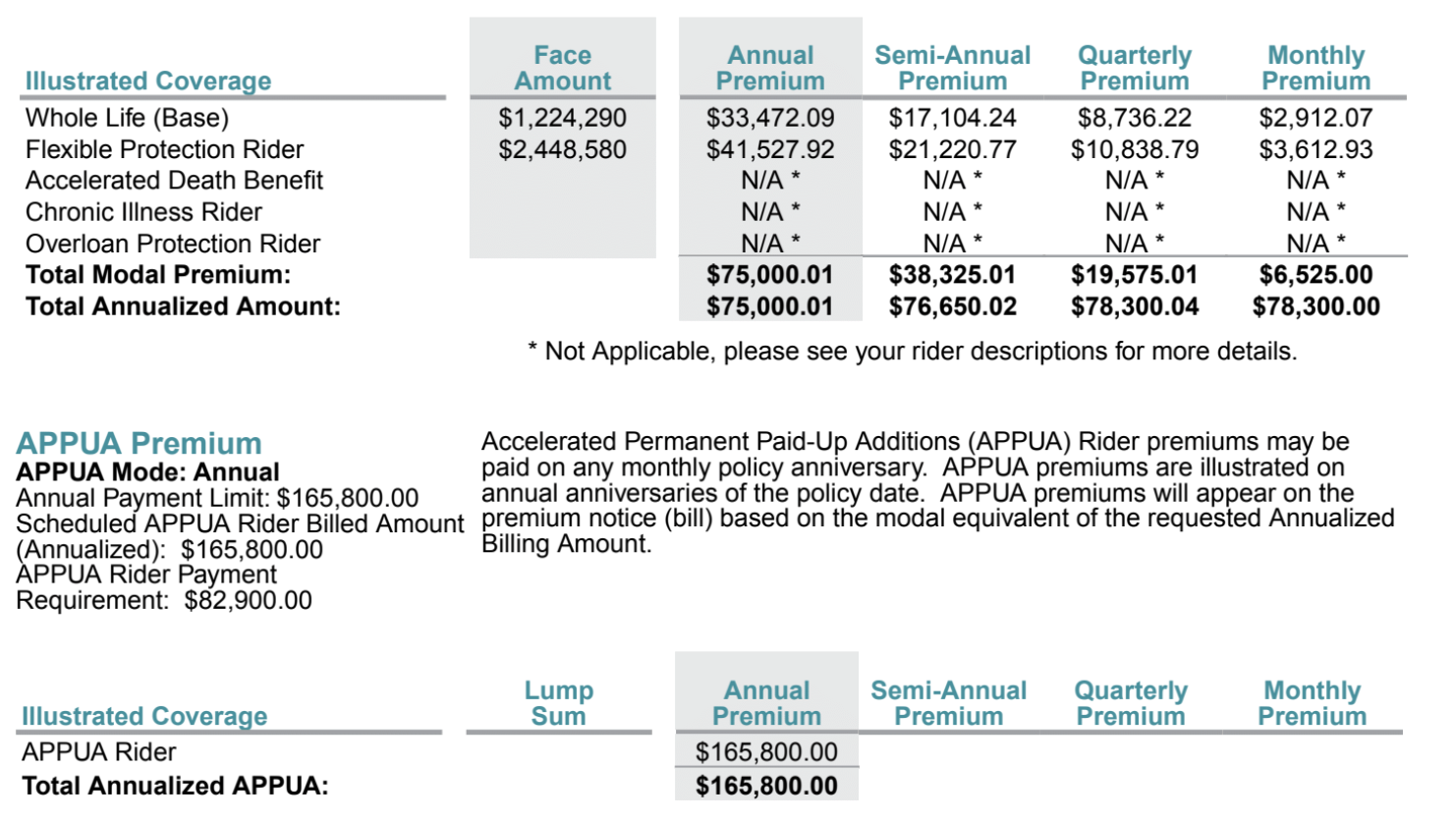

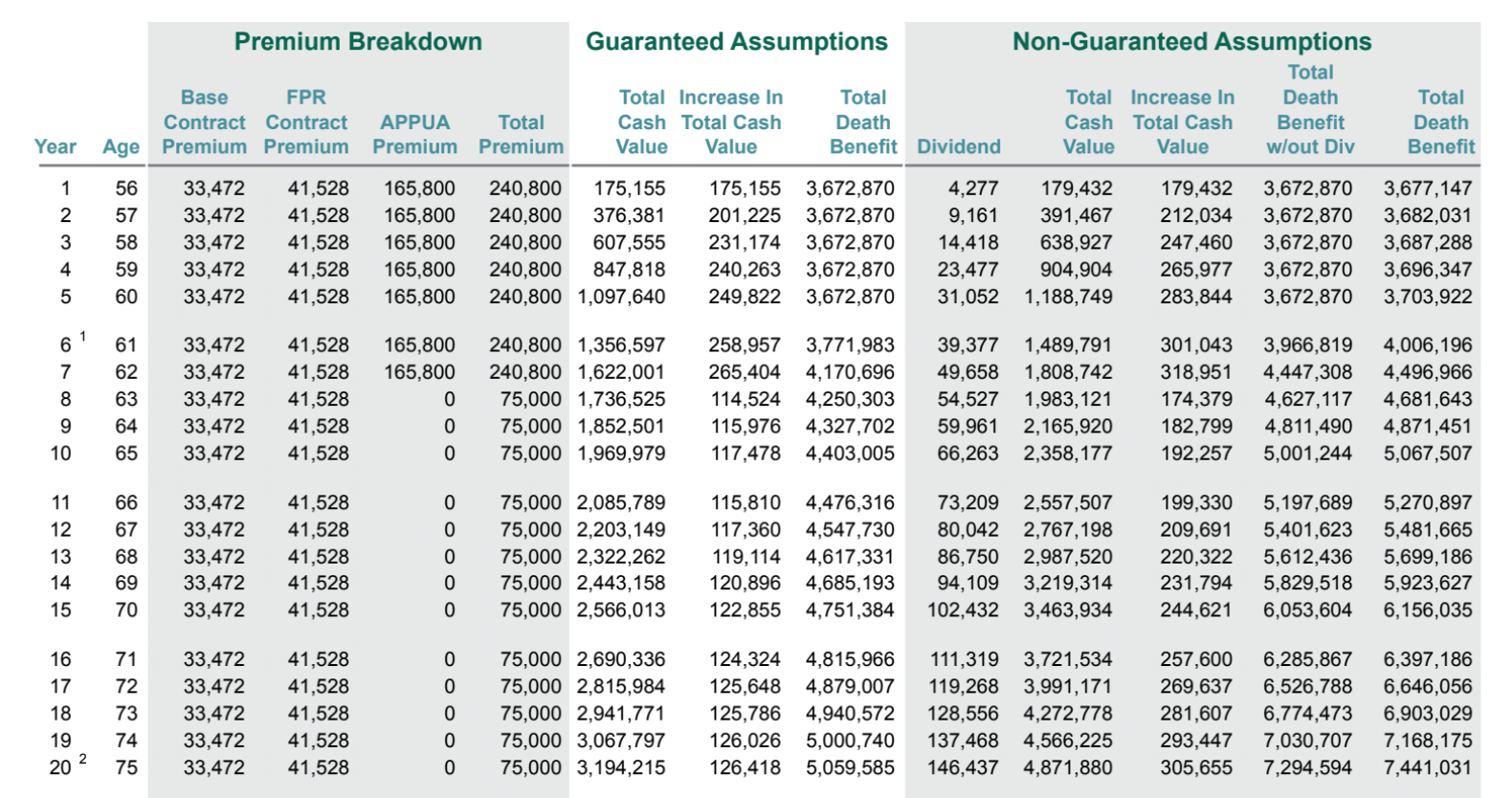

56-Year-Old Male; Accelerated Permanent Paid-Up Additions

In this example, a 56-year-old client had significant assets in equities, but was concerned that a volatile market and potential market crash would destroy his hard-earned retirement savings. To safe-guard his retirement investment, he pulled funds from a portion of his equities and placed them in the in a whole life insurance policy with an Accelerated Permanent Paid-Up Additions Rider.

By pulling equity money and purchasing paid-up additions with it, he’ll earn guaranteed growth, non-guaranteed dividends, and greater tax advantages. In this case, he pays $33k/year in annual premiums and an additional $41k for a Flexible Protection Rider, which is similar to same-insured term, for a total annual premium of $75k. The additional riders shown are included in his policy, but are free. In addition, he can contribute up to $165,800/year in paid-up additions. His minimum required PUA payment is $82,900/year.

Here’s how his premium payments are distributed between cash value and death benefit:

By opting for an accelerated version of a paid-up additions rider, this client is utilizing the 7-pay system, where he front-loads his PUA in the first 7 years of his policy for maximum growth, coming in just shy of the premium limit that would turn his policy into a MEC and increase his tax liability.

As you can see, in year 8 his premium drops back down. Also shown are the guaranteed cash value and death benefit amounts he will earn, his potential dividend earnings based on historical performance, and non-guaranteed assumptions.

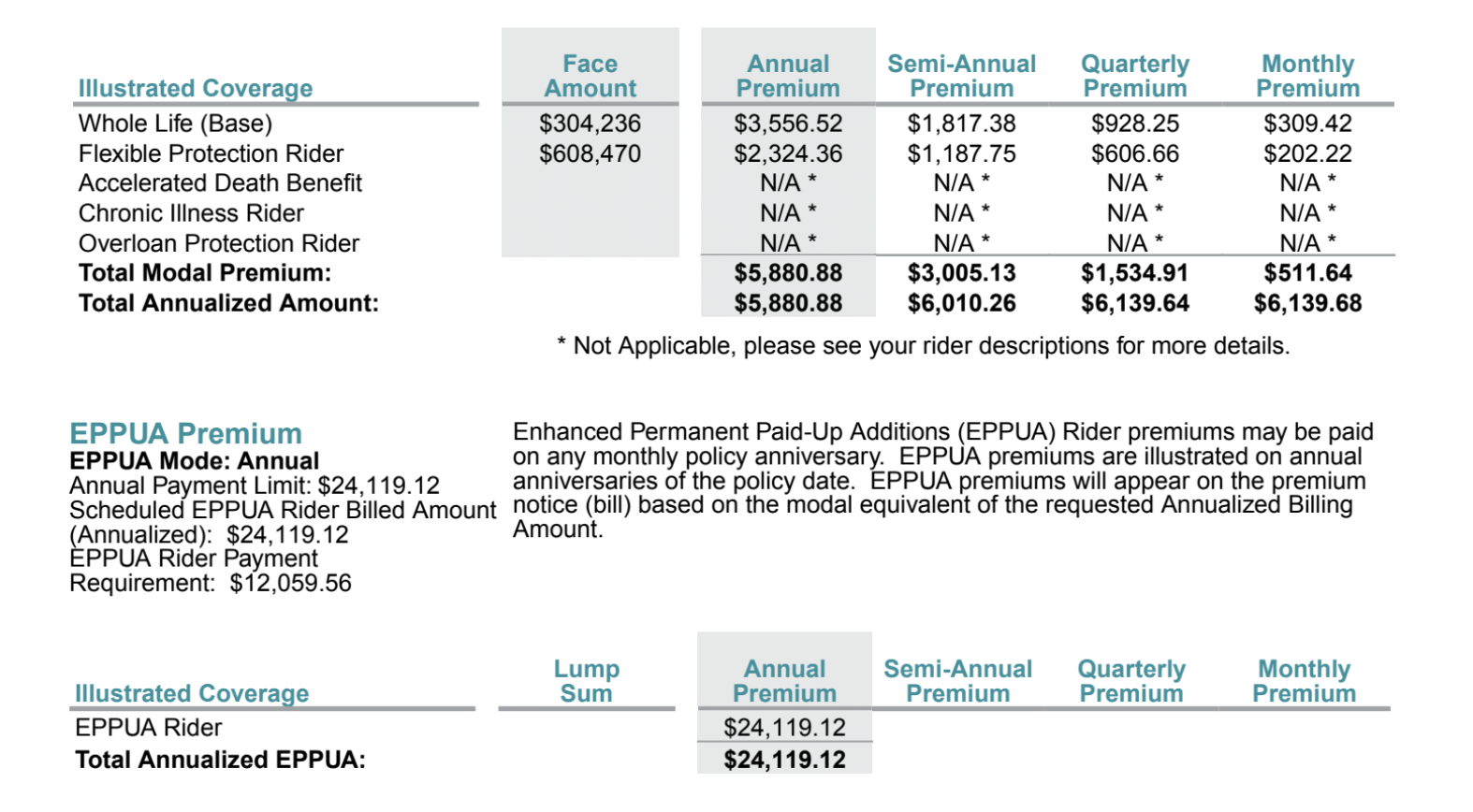

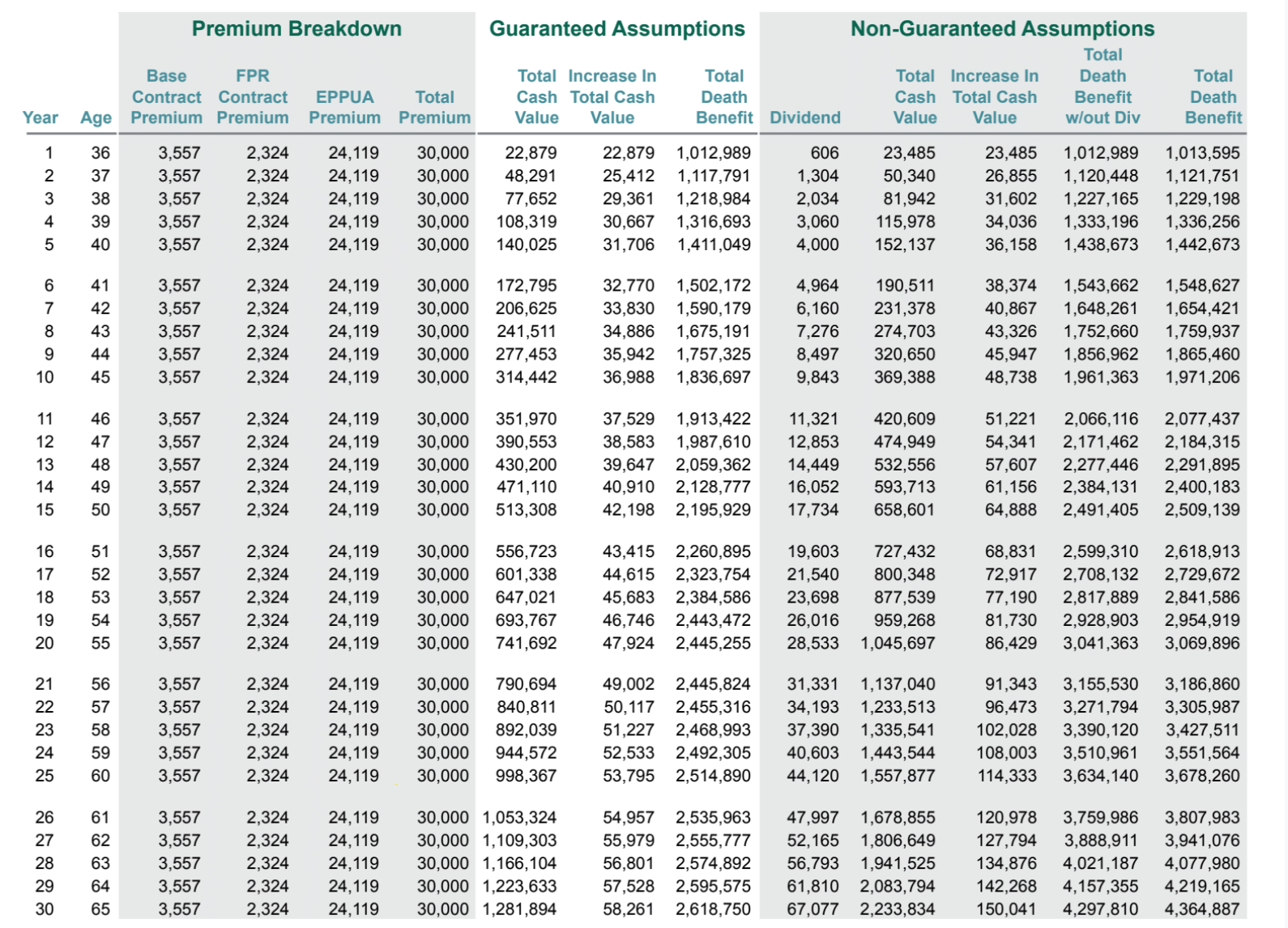

34-Year-Old Male, Enhanced Permanent Paid-Up Additions

In this case, a 34-year-old client was looking for ways to diversify from Wall Street and start building a financial foundation. An Enhanced Permanent Paid-Up Additions Rider helps him achieve that goal faster, but with a smaller premium requirement than the Accelerated Permanent Paid-Up Additions Rider used in the previous example.

His annual premium for his whole life policy is $3k, plus an additional $2k in for a Flexible Protection Rider, which further helps lower his overall premium costs, for a total annual premium of $5,880. He then can pay up to $24,119 in PUA premiums for faster growth within his policy, but must pay a minimum of $12,059 to keep this option.

With an Enhanced Permanent Paid-Up Additions Rider, this client will be paying less than the previous client, but over a longer period of time. Here’s how it breaks down:

This client plans to contribute to PUA until he retires, at age 65. However, according to historical data, he may have earned enough in dividends by age 54 to allow his dividends to purchase his PUA premium. By 65, he will have a guaranteed cash value of nearly $1.3 million dollars, which he can use to fund retirement.

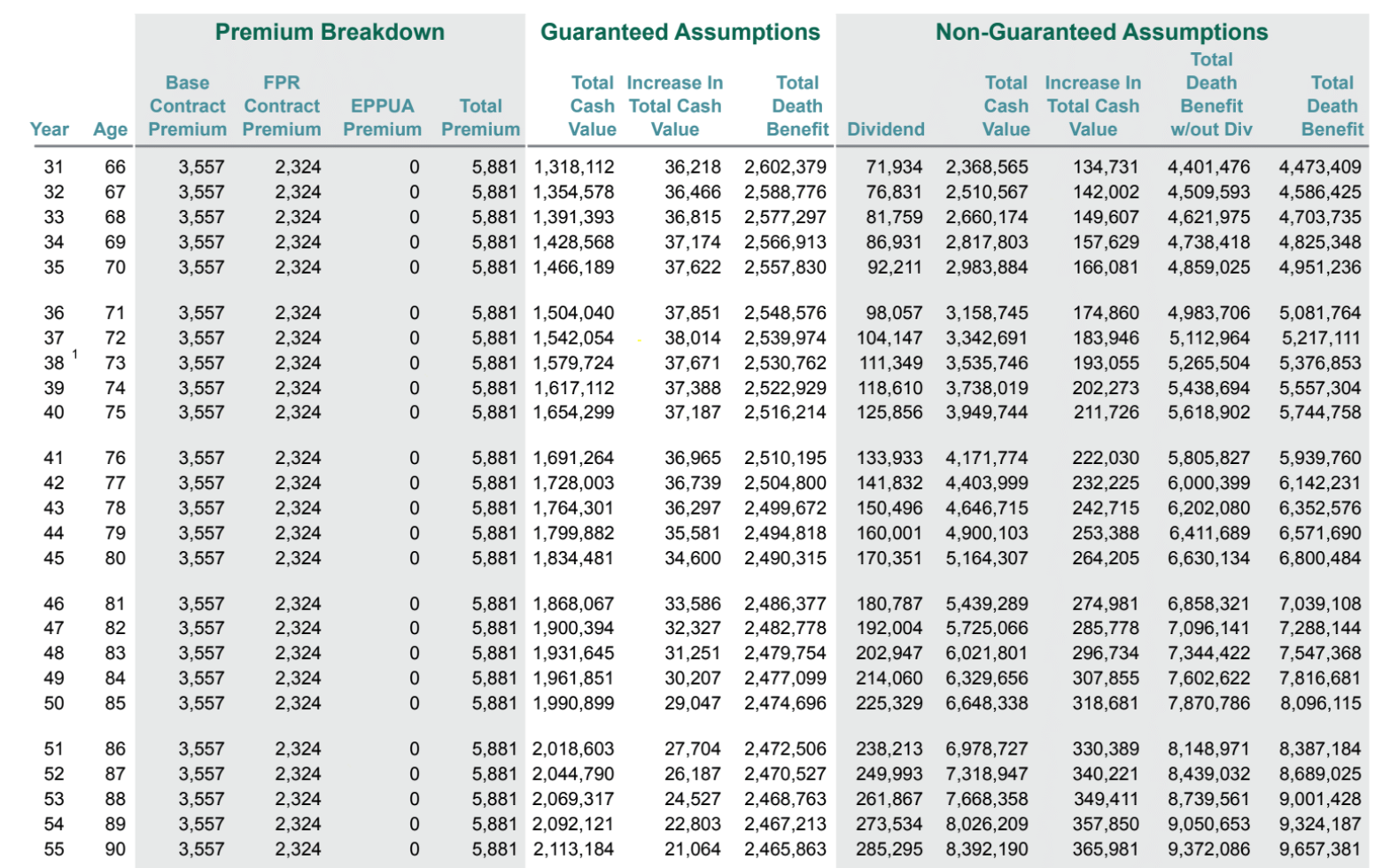

Here is what his policy will look like after it is “paid-up”:

At this point, the client is only paying his contract premium of $5,881. His dividends are more than enough to cover the cost of his premium at this point, effectively reducing his payments to zero. If he lives to be 90, he will have a guaranteed cash value of $2.1 million and a death benefit for his family of nearly $2.5 million. Looking at non-guaranteed assumptions, those numbers could be millions of dollars higher: nearly $8.4 million in cash value with a $9.7 million death benefit.

Using a PUA Rider as a Financing Strategy

When you purchase a whole life policy, and are using the cash value as a tool or strategy to finance other performing assets, it is advantageous to add a paid-up additions rider, otherwise you are subject to slow cash value growth. When trying to maximize your policy’s cash value benefit, there is no other way to do that than with the PUA rider.

What if you can’t add a PUA rider to an existing policy, or what if you’re unhappy with your existing permanent insurance?

A PUA rider is the only way to transfer funds from one insurance policy to another while still maintaining your tax-advantaged growth.

Thanks to section 1035 of the IRS Tax Code, you can salvage tax benefits in an existing permanent insurance policy and move them into another whole life insurance product, but only in the form of paid-up additions.

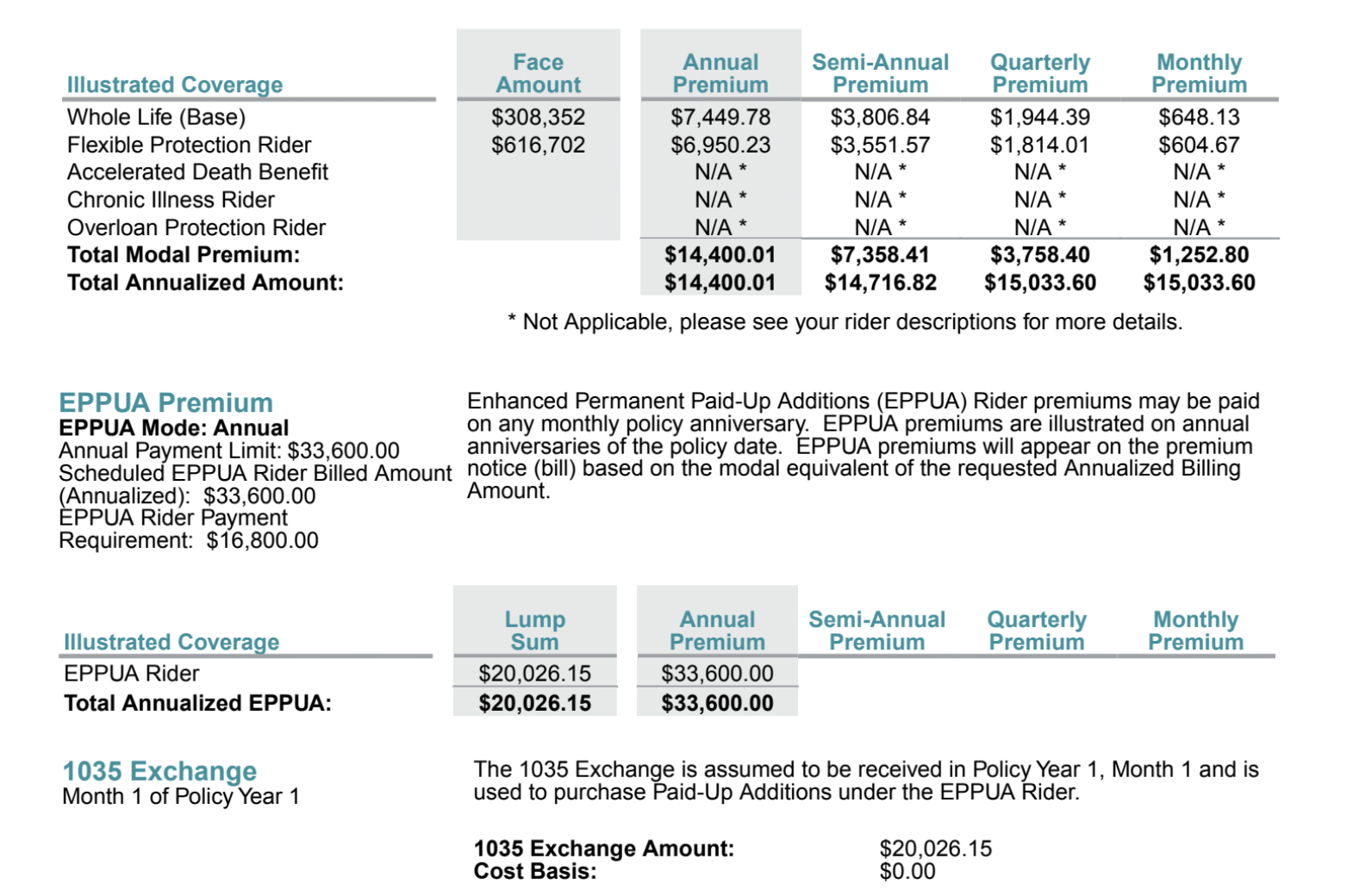

The following example comes from a 54-year-old Paradigm Life client who had a failing universal life insurance policy. He wanted to switch to a whole life insurance policy, where he would get a guaranteed rate of return, level premiums for life, and maintain his tax benefits.

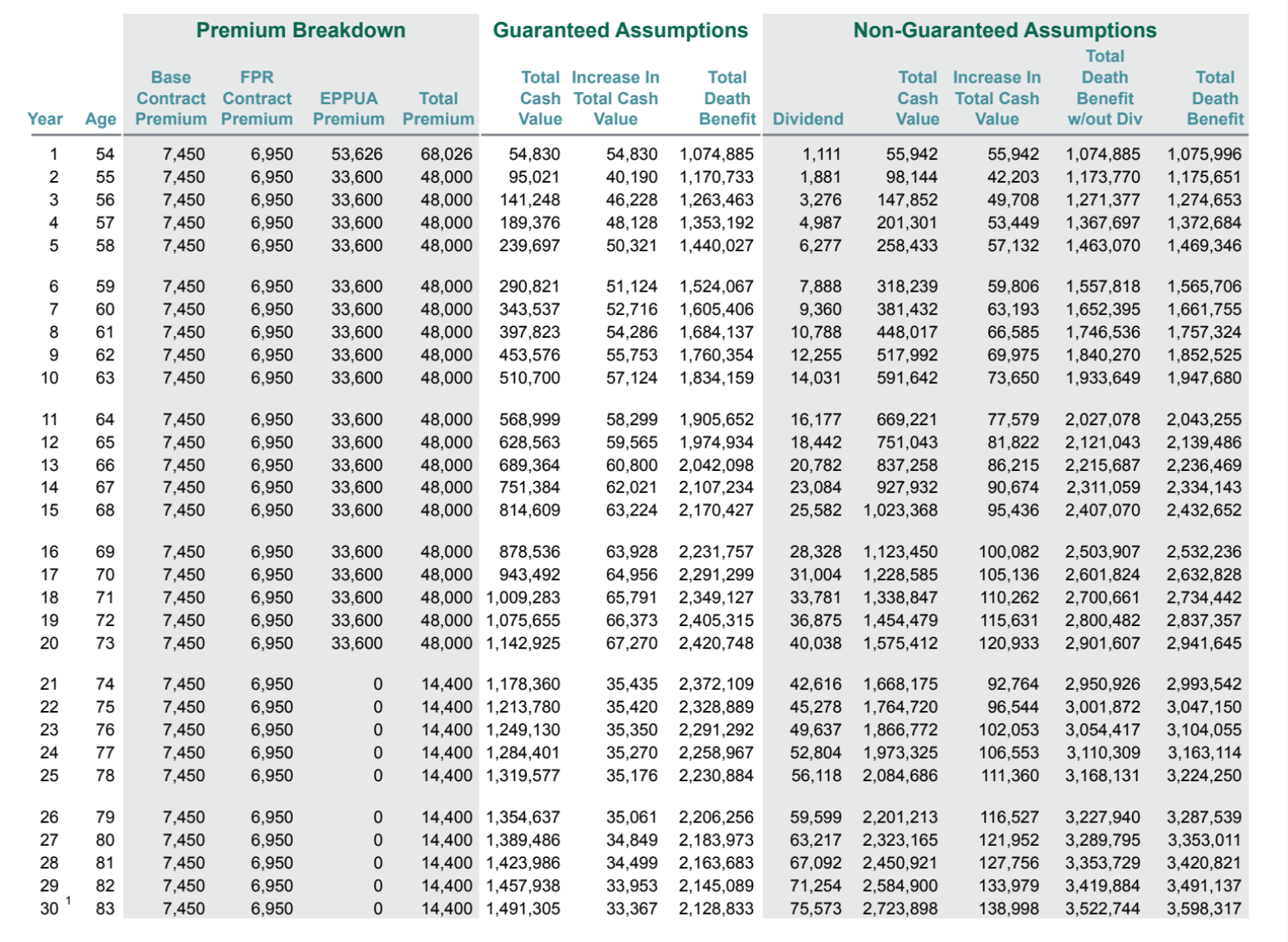

This client has a base policy premium of $7k, plus another $7k for his Flexible Protection Rider, for a total whole life premium of $14k. In addition, he’s purchased Enhanced Permanent Paid-Up Additions with a max annual premium of $33,600 and a minimum requirement of $16,800/year. But he also has $20,026.15 leftover from his old universal life policy that he can contribute in a lump sum as a 1035 Exchange the first month of his policy. This amount is added on top of his annual premium, accelerating his growth in year one.

Here’s the breakdown:

In year one of his policy, his EPPUA Premium payment is $53,626, which accounts for his 1035 Exchange—the additional funds coming from his failing universal life policy. In year 2, his premium returns to the illustrated max rate of $33,600. He will continue to pay his PUA rider premium for 20 years, until he is 73 years old, however his dividends may be sufficient to pay his PUA premium by the time he is 71.

A Note on Dividends

Mutual insurance companies typically pay out dividends each year. Though dividends are not guaranteed, most mutual insurance companies have such a long history of dividend payout (even during the Great Depression), that receiving a dividend can be expected (Forbes.com).

Life insurance and paid-up additions riders are an excellent wealth building strategy.

To add a paid-up additions rider to your policy, convert an old policy with a 1035 exchange, or to learn more, our Paradigm Life Wealth Strategists are here to help. You can  .

.

Read: Access Your Savings Tax Free

Watch: The Financial Climb

Listen: The Wealth Standard Radio with Rich Dad Advisor, Andy Tanner