The Federal Death Tax Explained

Never has a single tax been as notorious as the Death Tax, properly known as the Federal Estate Tax. The IRS defines this tax as “a tax on your right to transfer property at your death.” The controversy surrounding the Death Tax spans from those paying this tax and those fighting for it, citing that “this tax prevents an oligarchic concentration of wealth to a few families, and is the best way to encourage the wealthy to contribute to charities and foundations. They say estate tax is the only way to prevent wealthy families from passing down their wealth tax free, generation after generation.”

Regardless of the equitable or inequitable nature of the Death Tax, there are some Death Tax facts that everyone should know before they finalize any plans about what you will leave, who you will leave it to, and how you leave it to them.

Here’s the rundown on the Death Tax

What assets are included?

Most people think only about cash and property when they think about the Death Tax. But for the purposes of this tax, all assets are included in the calculation, including property and cash, as well as securities, trusts, annuities, business interests, retirement accounts, and some death benefits from insurance policies (With regard to life insurance, a life insurance policy that is payable to a living beneficiary is not included, but life insurance that is payable to the deceased person or the deceased person’s estate is included). To calculate the Death Tax, assets are assigned a fair market value instead of what was paid for the asset or what the value was when you paid for the asset.

Who pays?

The Death Tax is assessed based on the gross amount passed on, but there are a few exceptions. If the estate is left to a surviving spouse or a tax-exempt charity, the Death Tax does not apply……yet. Unless the estate is left to one of these excepted parties, your estate will be subject to the Death Tax if upon your death, the net value of your estate is more than the exempt amount.

One important thing to note is that dividing the estate between multiple parties has no effect on the amount of tax due. Whether the estate is gifted to a single individual or ten people, the tax due is calculated on the amount the decedent leaves behind, not the amount received by each inheritor.

How can you avoid it?

Unless you do some prior planning, 100% of your assets will be added together for a total net value. The estate tax amount is then calculated based on the net value of property owned by a deceased person on the date of death. There are many ways to plan ahead to prevent this massive tax for those with significantly large estates. Some of those include the annual gift allowance prior to death, or establishing trusts that remove assets from your estate, such as irrevocable life insurance trusts, dynasty trusts, qualified personal residence trusts, and grantor retained annuity trusts. Other methods may include transferring assets to an LLC or buying whole life insurance.

Not just for the rich

Although the exemption for the Death Tax seems large, many people erroneously assume that the Death Tax is only for the exceedingly wealthy. Although it’s true that only a small number of estates exceed the estate tax exemption, it is possible for some traditional middle-class individuals to be subject to this tax due to a large insurance policy, a healthy retirement account, an inheritance, significant real estate, or business interests. It has been estimated by the Tax Policy Center that 3,800 estates had to pay estate taxes in 2013.

Today’s exemption is $5.43 million, which means that the first $5.43 million of any estate is not subject to the tax. For any estate exceeding $5.43 million in value, there is a graduated scale to determine tax due, which tops out at a whopping 40% tax rate.

A farmer, for example, may have significant assets. They have significant real estate, multiple buildings, inventory, and costly equipment. They likely have a retirement account and most assuredly have a life insurance policy in place to protect loved ones. Upon death, all of these are included when calculating the appropriate Death Tax due.

What happens if an Estate is Taxable?

What happens if the estate exceeds the federal estate tax exemption for the year of the decedent’s death? Then the estate will have to file a federal estate tax return with the IRS within nine months of the decedent’s date of death. Along with this tax return, Form 706 and corresponding payment is due. An automatic extension can be applied for, but the payment itself cannot be delayed without accruing interest.

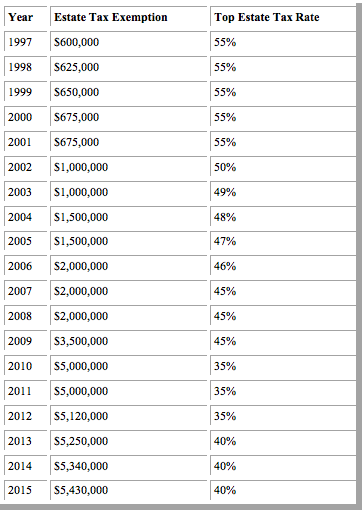

For historical changes to the federal estate tax exemption and rate from 1997 to current, refer to the following chart:

State Death Taxes

Aside from federal estate taxes, a handful of U.S. states collect a death tax at the state level as well (currently 20 states have an additional state death tax).

In some states the tax is based on the overall value of the estate, which is referred to as an estate tax, while in other states the tax is based on who inherits the estate, which is referred to as an inheritance tax.

How do I plan for all of this?

Everyone with a sizable estate needs to plan ahead. In 2010 the estate tax exemption was on schedule to drop to $0, and again in 2013, the exemption was scheduled to drop from $5 million to $1 million, which would effect a very large number of families.

While we know what the current federal estate tax rules are and that they are supposed to be “permanent” going forward, as the saying goes, “A law is only permanent until Congress decides to change it.” So as the struggle in Washington continues to keep incoming revenues up to speed with the exorbitant amount of government spending that is occurring, Congress may very well be forced to close some of the “loopholes” that the wealthy have benefited from in the past in order to decrease the values of their estates for estate tax purposes.

Since it is very likely that some of these exemptions will be eliminated or reduced in the future, it is important to keep current on the our administration’s revenue-generating proposals and the ongoing discussions about completely overhauling the Internal Revenue Code to avoid being blind-sided by a change that will affect your income tax liability and estate planning goals.

I highly recommend a great estate attorney as well as knowledgeable financial advisors that keep current on the laws and tools to protect your family and the assets you have created during your lifetime.