Stop Choosing to be Broke!

“I am NOT choosing to be broke!” you may be shouting to your computer screen right about now. However, the reality is that unless you

“I am NOT choosing to be broke!” you may be shouting to your computer screen right about now. However, the reality is that unless you

You lie awake, palms sweating, wondering to yourself why that investment seemed so promising. The ‘what if’s’ tumble through your mind like one of those

Your bills are paid on time, you have some money put away in a savings account, and you even have managed to invest some additional

You’ve heard the old saying that “Cash is King.” Those who have the cash, make the rules, it says. Well, today, let’s use that idea

There is a wealth of knowledge available when it comes to learning about how to invest and life insurance. So much that it may seem

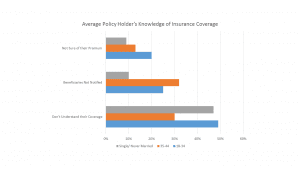

Here are some of the hard facts: Women are more confident at meeting short-term financial goals. (prudential.com) 52% of women expect to work past retirement

One of the aspects I like most about my role in advising clients is that we get to talk about a lot of

What message does it send to children when they are given control of their parent’s purchasing power? IPad for seven years olds, cell phones for

Doctors, dentists, counselors, and life insurance agents. They all have something in common; there are key factors that need to be present before we officially

He hung up the phone, it was HR, it was his turn to meet with the ‘retirement plan’ specialist. While it wasn’t mandatory, the many

Well-known Stamford Connecticut philanthropist Thomas Ruddmucker passed away last week. And while he was known for his generosity, his last act in life is seen

Wherever there is public opinion, the potential for misconstrued truths and even myths are probable. Whole Life Insurance is no exception. There are many misunderstandings