Just like Warren Buffet says, “Be fearful when others are greedy, and greedy when others are fearful.”

This couldn’t be a truer and more relevant statement for everyone in the U.S. economy right now. Interest rates are on a steady rise and the recession seems to be getting under control, but it doesn’t mean we can trust the stability – or lack thereof.

All eyes are on the Fed as reports form the Brookings Institute conference, held earlier this month, focused entirely on the effects of quantitative easing and how it contributes to current wealth inequality.

Quantitative easing, for the FED, is unconventional monetary policy to be used only as a last resort. Typically, to maintain their mandate of maximum employment and price stability, the Fed usually focuses on lowering the federal funds rate (the rate at which banks borrow from each other) to stimulate the economy, not buy government bonds. Focusing on the federal funds rate is a policy tactic meant to ignite the economy as it lowers what banks charge consumers to borrow money.

Though quantitative easing echoed FDR’s New Deal, and other countries like Japan and parts of Africa have seen success from QE, studies show that quantitative easing really only helps more underdeveloped countries.

According to Brookings, the reason why QE didn’t help the U.S. is because the stimulation was central to assets-only. This type of stimulation only helps wealthier individuals as they are vested in the markets. Ninety-six percent of Americans make their money from labor, not the stock market. (Forbes.com)

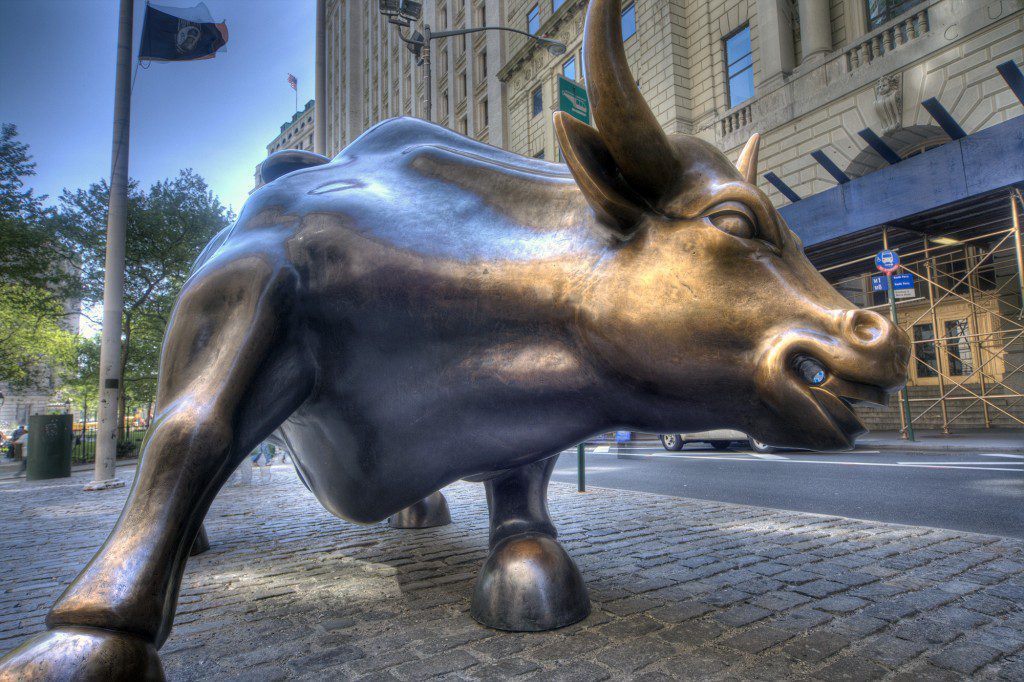

So, though it’s a bull market, it doesn’t mean you should trust the current indicators. Many believe that we have gotten in over our heads with a debt-ridden economy that supports dishonest investing. “We live in a chaotic world with total instability and a lot of malinvesting. People don’t save, they listen to the Fed. Debt gets liquidated, and there will be an unwinding of this pyramid of debt somehow,” said Ron Paul in a CNBC interview.

For many people saving is just too difficult. Of the 96% of Americans who work in the labor force, 76% are living paycheck to paycheck. (CNN Money) Can you blame this lack of saving and wealth inequality on quantitative easing, or the overall attitude toward debt in our country?

Fighting False Indicators

At Paradigm Life, we combat market volatility in a way you wouldn’t expect. We’re wealth strategists, not financial advisors or investment bankers, so we are not concerned with market yields. Many of our clients do not invest in the stock market after working with us, instead they keep their money safe (and still growing) in a Whole Life Insurance Policy.

Life Insurance – the way we build it – is a protected asset that is absolved from market volatility. Because your policy comes with cash value, it earns a steady and consistent return. You can also borrow against your policy to access liquidity, in addition to receiving a death benefit.

It’s the living benefits that make whole life insurance a foundational asset. The rich have used whole life as wealth strategy for hundreds of years.

With the economy trending like it is, do you feel comfortable not looking into alternative money methods?