How to Make Holiday Spending an Investment

As the holiday season approaches, the annual dent in your finances draws near. Some tried and true methods like budgeting, making extra money, or being frugal can help reduce that dent, but we want to show you a way to make a dividend on the money you spend during the holiday season. Don’t believe us? Keep reading. You can do it through what we call the Perpetual Wealth Strategy and a Wealth Maximization account.

The Perpetual Wealth Strategy

In our recent blog 6 Steps To Banish The Consumer Debt Haunting You, we gave details about creating a Perpetual Wealth System for yourself and your family. Here we offer a brief version of the strategy, and how you can apply it to literally make money while you purchase gifts for the holidays.

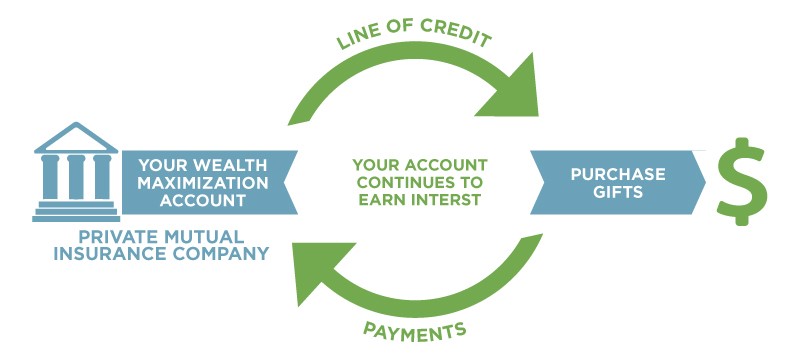

The Perpetual Wealth Strategy involves adding cash value to a permanent life insurance policy, borrowing from your cash value, and paying yourself back. When you structure your life insurance policy the right way, you have the option to borrow from your cash value and purchase anything you want, in this case holiday gifts. At your own terms, you’ll pay yourself back at about a 4% interest rate. The secret sauce here is that you’ll still earn about a 10% return on the entire value of your cash addition, because as a policy holder you are part owner of the mutual insurance company—these companies have paid a dividend every year for a hundred years. It’s a no-lose situation.

All of this literally translates to earning interest, even on the money you’ve borrowed for holiday spending. Simply put, here are the steps:

- Get a policy with a cash addition—a Wealth Maximization account.

- Borrow from yourself and purchase holiday gifts.

- Pay yourself back at a low-interest rate of about 4% while your policy earns a return of about 10%.

Click the link to our free eCourse called Infinite 101® at the bottom of this post to get started. After you have your holiday financial strategy in place, implement your own techniques to capture all the treasures of the season. Below are some of our favorite suggestions.

Holiday Treasures of All Kinds

Cut costs. Saving money while you spend money is always tricky, here are some proven techniques to get your holiday costs down:

- • Pay in cash

- • Create a budget

- • Make a list of people and gifts

- • Use last year’s holiday supplies and décor

- • Buy on sale

- • Buy for meaning, not bling

- • Give homemade gifts

- • Consider a white elephant exchange for adults

- • Offer your skills or service as gifts

Give to charity

Giving is traditionally the best way of receiving. As you offer what you have to others, you not only help take care of less fortunate folks, you teach your family the joy of giving. In some cases you can also get a tax deduction:

- • http://www.amazinggoodwill.com/donating/IRS-guidelines

- • http://www.shareyoursoles.org/

- • https://soles4souls.org/

- • http://giverunning.org/

- • http://www.dressforsuccess.org/supportdfs_donate_clothing.aspx

- • http://www.changepurse.org/donate.php

- • http://www.planetaid.org/find-a-bin

- • http://www.secondchancetoys.org/

Create a legacy

Memories are the greatest gifts you can give family and friends. It’s very likely your children will follow the traditions you put in place. If you place a bigger emphasis on service and spending time as a family than giving and getting gifts, they will pass that legacy to their children as well. These activities will help:

- • Leave presents or food on the doorstep of a less fortunate family

- • Sing carols or deliver cookies at a local nursing home or assisted living facility

- • Bake some of the same desserts or play the some of the same games every year

- • Write a family mission statement and goals for the coming year

- • Trace your family’s lineage

“Happiness cannot be traveled to, owned, earned, worn or consumed. Happiness is the spiritual experience of living every minute with love, grace, and gratitude.” — Denis Waitley

“We can experience any kind of pleasure and pain either too much or too little. But to experience all this at the right time, toward the right objects, toward the right people, for the right reason, and in the right manner — that is the median and the best course, the course that is a mark of virtue.” — Aristotle

Our Free eCourse

Give yourself a gift before you even begin shopping. We want to help you build wealth outside of Wall Street with certainty, liquidity, and control. The first step to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.