Regardless of the way you celebrate, it’s beginning to look a lot like the holiday season. Most people approach the holidays with a surprised attitude. “It’s here already!” is a common expression and yet, the holidays come the same time every year. When you feel rushed and you have no plan, your holiday decorating and giving expenses can escalate—even when sales are everywhere. Whether the holidays sneak up on you or not, it’s a great idea to plan and track what you spend.

Nearly two-thirds of American families don’t know the true cost of their own holiday celebrations—and if they did, they’d be shocked. Some financial experts advise keeping your holiday budget within two to five percent of your annual income. Whether your holiday budget is tight or plentiful, planning and tracking what you spend gives you a realistic perspective of what you spend during the holidays, and that gives you something valuable—control over your money. Control over your money always gives you peace of mind, regardless of how much money you have. So, no matter if you’ve started shopping or not, you can do these few simple things to regain control.

1. Plan

Make a list of planned items you’ll buy. Create it in a spreadsheet, notebook, or on a napkin—it doesn’t matter, just start writing down what you need to purchase. Include everything holiday related (wrapping paper, neighbor gifts, décor, donations, and of course gifts). You don’t need to leave any people off of your list, you just may need to adjust the amount you spend on them (or give a card, or handmade gifts at a lower cost).

Next, if you’ve actually used a napkin, you’ll want to transfer your information to a notebook or computer. Then start thinking about the amount you want to spend for each person or item. Once you’ve got those numbers in a table, review and make a commitment to the amounts.

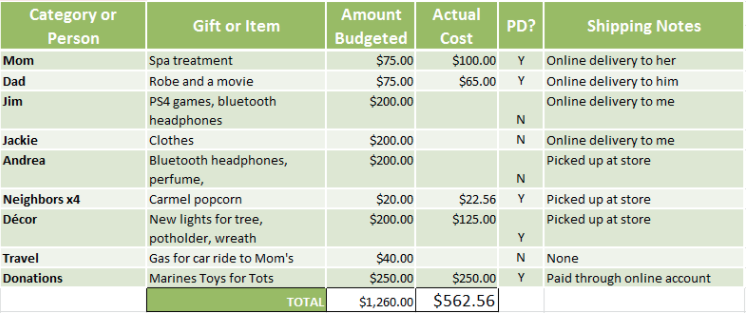

Here’s an example of a simple spreadsheet created in Excel to show you how easy it is to get started.

2. Track

Now the fun starts. Fill in everything that you have already purchased and start recording after new purchases. Save all of your receipts in a separate envelope and put the amount in your budget immediately or as soon as possible (if you’re shopping online you’re already on the computer, right?). Remember that even a “best guess” at what you spent is okay. Just get a ballpark number in there as soon as possible.

Add in unexpected or overlooked expenses (like potluck parties or the kids’ teachers) by adding lines within your Excel table or creating another table in your notebook, keep track the same way as other items and make sure the totals are added together.

3. Review and Refine

Make it a game to stay in budget. Aren’t you excited to see how you did? Of course you’ll have unexpected expenses come up, and at first try you may have been a little off in your numbers, but now you have a baseline—a number to shoot for in your savings and a place to start from next year. Keep your computer file or notebook handy so you don’t need to rethink the process again next year. This method is also a great way to budget for other holidays, birthdays, dinner parties, and more.

If the reality of sticking to a holiday budget has you feeling like a scrooge, try making a plan to save a set amount each month throughout the year so you can give a little more next year. An easy holiday budget is a great way to bring more peace into the season. We all know that the real reason for any holiday is to express love and appreciation, both of which can be done without any money at all—creativity and an attitude of gratitude are the greatest resources you have. Think about giving gifts of service or time, like writing a letter sharing your gratitude for someone or giving gift certificates for a weekend trip together. The holiday season is as much about making memories as it is about giving gifts.

Our goal at Paradigm Life is to help you navigate your personal finances by offering continual education. We want to share a financial model with you that could actually help you finance next year’s holiday expenses. It’s called the Perpetual Wealth System, and it allows you to grow your wealth, access cash value, and leave a legacy for your family. We are excited to invite you to take 2 minutes to sign up for a FREE, extensive eCourse called Infinite 101®. You’ll receive access to video tutorials, articles, and podcasts. It literally costs you nothing to become educated on this ideal financial strategy and start changing your wealth paradigm!

Take advantage of this FREE resource by clicking below.