As the concept of Infinite Banking gains popularity in the financial world it is important to understand the basics. What is Infinite Banking and how does it work? More importantly, who is Infinite Banking for? For many newcomers, it can be difficult to conceptualize. If you’re trying to understand if Infinite Banking is right for you, this is what you need to know.

What is Infinite Banking?

The concept of Infinite Banking was created by Nelson Nash in the 1980s. Nash was a finance expert and follower of the Austrian school of economics, which advocates that the value of goods aren’t explicitly the result of traditional economic structures like supply and demand. Rather, individuals value money and goods differently based on their economic status and needs. Out of this thought, Nash developed the idea of individuals becoming their own bankers to better achieve their own unique, individual financial goals.

Listen: R. Nelson Nash, Founder of the Infinite Banking Concept®

One of the pitfalls of traditional banking, according to Nash, was high-interest rates on loans. Too many people, himself included, got into financial trouble due to reliance on banking institutions. So long as banks set the interest rates and loan terms, individuals didn’t have control over their own wealth.

Becoming your own banker, Nash determined, would put you in control over your financial future. But in order for Infinite Banking to work, you need your own bank.

The Role of Whole Life Insurance in Infinite Banking

Nash determined that the best financial tool for Infinite Banking is whole life insurance.

Infinite Banking is NOT whole life insurance. But the Infinite Banking concept works best when the banker—you—utilizes properly structured whole life insurance as your bank.

Using whole life insurance as a financial tool for building wealth wasn’t a new concept in the 1980s. Business moguls like John Rockefeller built fortunes using whole life insurance and used their insurance policies to pass on wealth that has lasted for generations. Large companies hold millions of dollars in whole life insurance to help fund business expenses and earn favorable tax advantages. Even banks use whole life insurance as Tier 1 assets.

In fact, whole life insurance was even taught as a college course at the Wharton School in Pennsylvania. The curriculum? How to use the cash value of insurance policies to fund business expenses, entrepreneurial ventures, investment opportunities, get out of debt, purchase real estate, and more.

By the time Nash created the Infinite Banking Concept®, the idea of using policy loans as an alternative to banks and as a way to privatize family wealth wasn’t new. The name “Infinite Banking” was Nash’s way of marketing the concept to his clients, putting a fresh spin on a centuries-old strategy. At Paradigm Life, we call it The Perpetual Wealth Strategy™.

How Whole Life Insurance Works in Infinite Banking

Whole life insurance policies come with a cash surrender value, also known as cash value. The cash value of your policy is the amount of your death benefit the insurance company is making liquid to you. If you were to cancel your policy while still living, the cash value is the amount the insurance company typically pays you. But as long as your policy premiums are paid, the cash value of your policy can be used for personal and business loans with your policy as collateral.

Unlike term life insurance, which only serves to financially support your beneficiary after you pass away, whole life insurance covers the entirety of your life and offers benefits to you, the policyholder, while you’re still living.

There are two different types of whole life insurance: participating and non-participating. The main difference between the two is that participating whole life insurance policies allow you to participate or receive dividends based on profits of the insurance company. With non-participating policies you do not participate or receive dividends from the insurance company.

If you use a participating whole life insurance policy for Infinite Banking, your cash value increases every time the insurance company pays dividends. It also increases when you pay policy premiums and earns a guaranteed interest rate.

Essentially your “bank” consists of a portion of premiums paid (money from you) + guaranteed interest earned + potential dividends (money from your insurance company).

Instead of storing your savings in a traditional bank account with minimal returns, you save inside of your dividend-paying whole life insurance policy, where it grows tax-free with a higher rate of return.

The Policy Loan

You can access the cash value of your whole life insurance policy at any time, for any reason, including real estate purchases, tuition, other investment opportunities, business capital, emergency expenses… you name it. But to take full advantage of the Infinite Banking concept, it’s best to use your cash value in the form of a policy loan rather than a withdrawal.

When you utilize the policy loan feature of your whole life insurance policy, your cash value continues to grow in spite of the loan. Every dollar you borrow still earns interest and potential dividends. When you pay back your policy loan, you recapture the interest—not a bank. This is the backbone of the Infinite Banking concept; your wealth continues to grow, even as you borrow against it. You are basically borrowing from yourself.

Additionally, policy loans are tax-free. You can use the interest and dividends you’ve earned without paying taxes on that money. Comparatively, if you withdraw your cash value, any amount over your basis—the amount you’ve contributed in insurance premiums—will be taxed.

In terms of paying back your policy loans, you function as your own banker and get to decide the payment schedule. Any unpaid loans will be deducted from your death benefit.

What Are the Advantages of Infinite Banking?

Infinite Banking is not a rapid money making scheme. Infinite Banking in its truest form is control over your money and the elimination of unnecessary money leaks from your own personal economy, so that you can utilize your money to grow and increase your assets.

Infinite Banking requires you to take responsibility for your own financial future, and for the goal-oriented individual it can be one of the best financial tools you’ll ever find. Here are the advantages of Infinite Banking:

Liquidity

Arguably the single most beneficial aspect of Infinite Banking is that it improves your cash flow. You don’t need to go through the hoops of a traditional bank to get a loan; simply request a policy loan from your insurer and funds will be made available to you. Whole life insurance is an extremely liquid asset compared to other assets like real estate, stocks, bonds, or qualified plans like your 401(k) or IRA.

Because whole life insurance is liquid, it can make up a valuable part of your financial foundation, acting as your emergency savings. Whether you run into unforeseen medical bills, job loss or costly home repairs, policy loans offer peace of mind. You can even use your insurance policy to pay yourself an income if you decide to go on sabbatical, return to school or take time off work to care for loved ones.

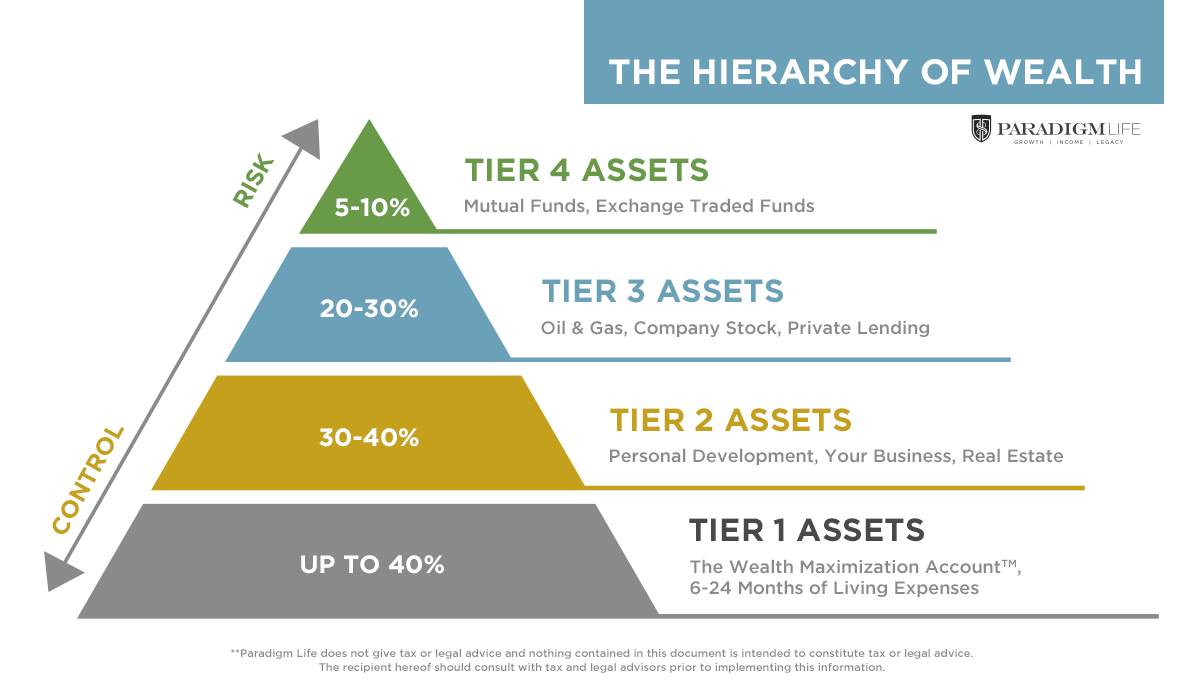

At Paradigm Life, we advocate funding a whole life insurance policy as a savings vehicle before considering other investment strategies like real estate or the stock market as part of our Perpetual Wealth Strategy™, and refer to this type of portfolio structure as The Hierarchy of Wealth™.

Control

Dividend-paying whole life insurance is very low risk and offers you, the policyholder, a great deal of control. The control that Infinite Banking offers can best be grouped into two categories: tax advantages and asset protections.

Tax Advantages

One of the reasons whole life insurance is ideal for Infinite Banking is how it’s taxed. In addition to tax-free policy loans and tax-free growth of interest and dividends inside your whole life insurance policy, the death benefit of a whole life policy is tax-free to your beneficiary and often is exempt from estate taxes as well.

Asset Protections

When you use whole life insurance for Infinite Banking, you enter into a private contract between you and your insurance company. This privacy offers certain asset protections not found in other financial vehicles. Although these protections may vary from state to state, they can include protection from asset searches and seizures, protection from judgements and protection from creditors. Plus, any policy loans you utilize won’t affect your credit score.

Protection Against Volatility

Whole life insurance policies are non-correlated assets. This is why they work so well as the financial foundation of Infinite Banking. Regardless of what happens in the market (stock, real estate, or otherwise), your insurance policy retains its worth.

Too many individuals are missing this essential volatility buffer that helps protect and grow wealth, instead splitting their money into two buckets: bank accounts and investments. The problem with this approach is that, while money in a bank account is safe, it offers a very low rate of return. Market-based investments grow wealth much faster but are exposed to market fluctuations, making them inherently risky. What if there were a third bucket that offered safety but also moderate, guaranteed returns? Whole life insurance is that third bucket.

Regardless of how diversified you think your portfolio may be, at the end of the day, a market-based investment is a market-based investment. In the event of a market downturn, you lose money. Maybe a lot. Maybe a little. Maybe your value doesn’t decrease but your returns do. With Infinite Banking using properly structured whole life insurance, your returns are guaranteed and your cash value won’t decrease.

Certainty

Not only is the rate of return on your whole life insurance policy guaranteed, your death benefit and premiums are also guaranteed. These certainties are another reason why properly structured whole life insurance is the ideal tool for Infinite Banking.

Consider other assets, like those associated with your 401(k) or IRA. In the event you pass away with money left in either of these qualified plans, the remaining funds will be passed onto your beneficiary—but first it will be taxed. You can guarantee your beneficiary will receive something but you can’t be certain how much, due to future tax rates.

While there are other types of permanent life insurance, whole life insurance is guaranteed to have the same premium for the duration of the policy. You can be certain your premium won’t increase as you get older. This is invaluable when it comes to setting and achieving your financial goals.

Cash Flow

Many individuals rely on Infinite Banking for a tax-free retirement. Because insurance policies are paid for with after-tax dollars, you don’t have to worry about your future tax rate like you would with a 401(k). So long as you utilize the policy loan feature of your whole life policy, you don’t have to pay taxes on the growth of your cash value. Simply fund your retirement with policy loans and your insurance company deducts the outstanding loan from the death benefit after you pass away.

When your retirement funds are linked to market-based investments, running out of money in retirement is a very real and valid concern for millions of Americans. Infinite Banking using properly structured whole life insurance can ensure you won’t run out of money in retirement, because your cash flow won’t be at risk if the market experiences a downturn. For this reason, some individuals opt to stop funding qualified plans like 401(k)s or IRAs all together and rely solely on the Infinite Banking strategy for retirement.

Legacy

Infinite Banking with whole life insurance is a proven method for building generational wealth, in part because the death benefit is tax-free and generally not subject to estate taxes.

In the case of large estates where federal or state estate taxes may kick in, it’s possible to utilize Infinite Banking inside of an Irrevocable Life Insurance Trust (ILIT). By naming the trust as the policyholder of your whole life insurance policies, even the largest of estates can be eligible for tax advantages that provide significantly more wealth to future generations.

What Are the Disadvantages of Infinite Banking?

Infinite Banking isn’t a one-size-fits-all strategy. It’s highly customizable and its effectiveness depends largely on your financial goals. Here are three aspects of Infinite Banking to consider when deciding if it’s right for you:

Qualification

Because Infinite Banking uses whole life insurance as its “bank”, it isn’t an option for everyone. You must be able to qualify for a life insurance policy. Qualification is based on your health and age.

At Paradigm Life, Wealth Strategists work with the nation’s top mutual insurance companies and can help match individuals interested in the Infinite Banking strategy with insurance companies most likely to approve their application. While it’s recommended to apply for a policy when you’re young and healthy, it’s possible to get insured even in retirement—you’re never “too old” to pursue the Infinite Banking strategy.

Cost

Compared to term life insurance, the premiums for whole life insurance are significantly higher. Keep in mind that you’re not just paying for insurance; you’re effectively committing to contribute a set amount into “savings” inside your insurance policy to be used by you whenever you choose while still earning a guaranteed interest rate and potential dividends.

That said, Infinite Banking isn’t ideal for someone living paycheck to paycheck. It requires an individual who is comfortable with saving a significant amount of income and who is focused on long-term financial goals.

Remember, when you utilize the Infinite Banking strategy using whole life insurance, your insurance policy’s primary purpose isn’t the death benefit, it’s the living benefits. Your main goal isn’t protecting your loved ones financially if something were to happen to you—that’s an added bonus. What you’re really protecting is your income. You’re shielding your wealth against bank interest rates and financing, market volatility, creditors, and taxes.

Mindset

Infinite Banking is a proven concept for growing and protecting wealth, but it’s not mainstream. You need to be comfortable with taking your financial future into your own hands and have a clear outline of your financial goals. You also have to be a good banker!

If you don’t pay back your policy loans (with the exception of using policy loans to fund retirement), you won’t see your wealth grow over the course of your lifetime and you be able to create generational wealth.

Does Infinite Banking Really Work?

Yes. The strategy behind Infinite Banking—using dividend-paying whole life insurance as your own personal bank for growing and protecting wealth—is proven to work, and has been used by families for hundreds of years. As with any financial tool, the benefits are largely dependent upon how the tool is used and requires clearly outlined goals to measure success.

For the fastest growth and optimal benefits, it’s recommended to pair dividend-paying whole life insurance with supplemental insurance called a Paid-Up Additions rider (PUAR).

A PUAR allows you to “overfund” your insurance policy right up to line of it becoming a Modified Endowment Contract (MEC). When you use a PUAR, you rapidly increase your cash value (and your death benefit), thereby increasing the power of your “bank”. Further, the more cash value you have, the greater your interest and dividend payments from your insurance company will be. You can then reinvest those dividends to purchase more Paid-Up Additions.

By adding a PUAR to your whole life insurance policy, you front load it to maximize its potential over the course of your lifetime.

To see examples of whole life insurance policies structured with Paid-Up Additions, explore these Paradigm Life Case Studies.

How to Get Started

Paradigm Life specializes in providing clients with the proper tools and education so as to take advantage of the benefits of Infinite Banking. In addition to structuring your policy correctly, we’ll make sure it’s personalized to fit your unique financial needs and goals. We take an active role in continuing to educate and provide guidance to our clients, even after your policy is in place.

To learn more about the Infinite Banking strategy, access our free eCourse Perpetual Wealth 101™ here.

Consultations with Paradigm Life Wealth Strategists are also free. For a personalized illustration,  .

.

Disclaimer: The Infinite Banking Concept® is a registered trademark of Infinite Banking Concepts, LLC. Paradigm Life is independent of and is not affiliated with, sponsored by, or endorsed by Infinite Banking Concepts, LLC.