“You’re not getting old; you’re getting ready.”

“You’re not getting old; you’re getting ready.”

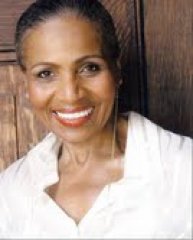

-Ernestine Shepherd, the world’s oldest female competitive body builder.

It’s a Fact: Americans Are Living Longer

According to the CDC (Centers for Disease Control and Prevention), life expectancy in the U.S. now stands at 78.8 years.

Women continue to outlive men, with life expectancy being 76.3 years for males, and 81.1 years for females. Life expectancy varies according to race and ethnicity. But don’t plug those numbers into a retirement calculator! It is mistake to assume that 78.8 years (give or take for gender and ethnicity) is YOUR life expectancy. Chances are, you’ll live much longer than you think you will.

Longevity in America: Understanding the Statistics

Statistics from the U.S. Census Bureau reveal that the 85-and over age group is the fastest-growing age group in America, and the over-65 population grew from 3 million in 1900 to 40 million in 2010 – an increase of more than 1200%. But during this same time, the over-85 population grew from just over 100,000 in 1900 to 5.5 million in 2010 – an increase of 5400%! (AgingStats.gov)

What do these numbers indicate? The longer you’ve already lived… the longer you can expect to live!

Life expectancy figures include those who die from all reasons and at all ages. Life expectancy of 78.8 years from birth takes into account everybody – those who pass away in their childhood or youth. And if you’re reading this at age 40, 50, or 60, your life expectancy is already longer.

According to the American Academy of Actuaries, who compile the statistics used by life insurance companies, a 21-year-old non-smoking male in good health is expected to live to 80. A 60-year old non-smoking male in good health is expected to live to age 84. Those that do live until 92 are likely to reach 96, and so on.

It’s true: The longer you live, the longer you can expect to live.

Longevity: The Reasons and the Challenges

The reasons for our increasing longevity are many:

- Advances in healthcare have put deaths from heart disease, stroke are on the decline, and diseases such as diabetes can be managed more successfully than 20 or 30 years ago.

- More senior citizens are prioritizing their health by remaining active, eating right, and taking supplements.

- Continuing care retirement communities provide opportunities for aging Americans to have better access to help or care as needed while maintaining active lives in a supportive community setting.

Longevity combined with monetary inflation is a recipe for disaster for seniors who haven’t saved enough or quit working too early.

While Social Security benefits comprise only about 38% of income for those over 65, about one third of recipients rely on social security for 90% or more of their income (SSA.gov).

With the average monthly benefit sitting just below $1,300, Social Security is clearly not enough to live on in the United States without supplementation.

How Long Might YOU Live?

Living longer can present tremendous opportunity, but may also present some tremendous challenges. The Life Expectancy calculator at The Social Security Website is a great trajectory for anyone wanting to get an idea of what their life expectancy could be. This calculator combines actuarial math with a survey that asks about family history, personal background, stress level, health habits, marital status and more.

It’s Time to Re-Think Retirement

Since living longer today is more likely than it has ever been, how does that effect your retirement dollars? Traditional qualified plans assumed for many years that life expectancy was to last until age 65 – shortly after one starts receiving their distribution. Now, one of the biggest retirement fears is outliving one’s money.

Whole Life Policy Insurance can help you combat outliving your money. Even if you have a qualified plan already in place, adding to your security with a Permanent Life Insurance policy can guarantee you cash flow during your golden years.

A Whole Life Policy, with its inherent cash value, can be used for whatever purpose you see fit. On top of the benefits that come with the flexible liquidity, your policy continues to earn a steady rate of return.

If you’re anything like Ernestine Shepherd, who was inspired to start exercising in her mid-50’s, and then was a competitive body-builder until age 74, I’d recommend getting your whole life policy sooner than later.

Read: Is Your Retirement Hanging Out to Dry?