How to Utilize Cash Value Insurance

Utilizing cash looks different for everyone. What’s great about owning a cash value insurance policy, also known as whole life insurance, is that when you

Utilizing cash looks different for everyone. What’s great about owning a cash value insurance policy, also known as whole life insurance, is that when you

By definition, “insurance” is a contract that provides financial protection against loss. Whether it’s loss of property, a job, health, even a particular skill or

What if you could access the death benefit of your life insurance policy while you’re still living? In other words, accelerate the benefits of your

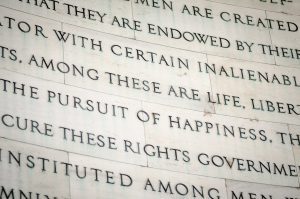

“When the architects of our republic wrote the magnificent words of the Constitution and the Declaration of Independence, they were signing a promissory note to

How much are you worth, really? Traditional bank statements tell you that your assets minus your liabilities determine your net worth. The workforce places a

Is a Tiny Home Investment Right for You? Tiny homes are all over reality TV and sweeping the nation. Whether you’d ditch your mortgage and

Eat, sleep, work, repeat… Does this rat race sound familiar? For many, the get-up-and-go-to-work routine this is the only way they know, simply trying to

Financial responsibility comes in many forms and is important for a multitude of reasons. When we are accountable for something within our control and management,

Did you make any resolutions this year? It’s not too late, especially if you’re vowing to make 2020 the year you gain financial control. But too

Cash, bills, coinage, notes, dough—our government is printing more cash than ever. But should we be ditching it instead? We love to fill our tub

What are your options when the stock market takes a dive and the interest rate on all of the “safe” investments is next-to-nothing? You don’t

NIRP stands for Negative Interest Rate Policy. Whispers of implementing this un-charted technique are running wildly through economic circles right now. When you know more