It’s not surprising to learn that only 56% of women have life insurance, compared to 66% of men. It wasn’t too many decades ago that the majority of women were stay-at-home moms and men were the primary breadwinners. But times have changed. The reasons why women need whole life insurance are more varied than ever before.

Today, women make up nearly 50% of the workforce, and 60% of households are dependent upon two incomes. What would happen to the majority of households if one source of income disappeared? With a death benefit average 22% less than men, even women who have insurance are under insured, leaving their families at financial risk.

Women In the Workforce

Whether you work full- or part-time to provide income for your family, your passing will create a hardship for your loved ones. Women need whole life insurance to guarantee financial security for a surviving spouse and children, as well as any other beneficiaries whom they care for.

As we struggle to close the gender pay gap, women should consider that employer-offered retirement products, like a 401(k), tend to have smaller balances than the portfolios of male employees—if they’re even offered at all. Many companies have reduced or stopped offering 401(k) benefits due to the current state of the economy. This means working women are less prepared for retirement. What’s more, according to Market Watch, 80% of women have no pension benefits and have lower Social Security benefits than men. Whole life insurance can offer greater income throughout your retirement, and greater flexibility if you plan to leave the workforce before age 59 ½, as there are no penalties for early withdrawal of the cash value of a whole life policy, unlike a 401(k) or IRA, and a variety of tax advantages.

Female entrepreneurs and business owners can benefit from whole life insurance twofold. Life insurance for business owners will help in all aspects of business. Not only can policies be purchased to protect family assets, they can be held on key stakeholders in business. Additionally, the policy loan provision of whole life insurance allows for greater liquidity and financial control. It can eliminate reliance on bank loans and lines of credit to back business purchases and investment opportunities. Interestingly some bank financed business loans require you to have a life insurance policy in place before being approved for the loan. If that’s the case, why not just fund a whole life policy and borrow from it instead of paying interest to the bank?

5 Ways to Use Whole Life Insurance for Business Owners

- Insure key employees

- Create a succession plan for your business

- Offer employee benefits free from market risk

- Use policy loans to fund expenses and large business purchases

- Create a buy-sell agreement to protect business partners

Women at Home

Just because you don’t bring home a paycheck doesn’t mean your passing won’t have a financial impact on your family. When you consider all the services you provide as a stay-at-home mom (cooking, laundry, cleaning, carpool, etc.) and the cost of hiring out those tasks, or the hours your partner would have to cut back to create time to complete these tasks, it’s easy to realize how much value you bring to the family. Whole life insurance accounts for this value and protects your loved ones.

Even if you’re not a parent yet, the time to purchase whole life insurance is now. Unfortunately, some carriers consider pregnancy (current and former) a pre-existing condition. It can affect your insurance premium. You’ll likely have more favorable premiums if you apply for your insurance policy before starting a family. Whole life insurance premiums don’t increase as you get older, so you’ll likely lock in the lowest rate right now.

Having your own insurance policy increases the spending power of your family bank, but it isn’t the only option. Some couples opt for a type of whole life insurance called a first-to-die policy. If you and your spouse are both relatively healthy and close in age, this type of policy could save money on your monthly premiums. (If not, a first-to-die policy could be more expensive because the cost of premiums will default to the oldest and/or least healthy person on the policy.) Whichever person outlives the other will be the beneficiary on the policy.

Women Without Children

Maybe you don’t plan to have children and aren’t as concerned about leaving a legacy behind in the form of a death benefit paid out to your beneficiary. There are still benefits of whole life insurance that can have a big impact on your financial goals. In fact, the living benefit of your policy has even more to offer than the death benefit.

Living Benefits of Whole Life Insurance for Women

-

Women need financial security:

Women report feeling less financially secure than men, partly due to gender inequality and pay gaps, but also because they assume caregiving responsibilities that pull them away from their careers. Even women who don’t have children face the likelihood of caring for a parent or in-law at some point in the future. Women need whole life insurance in order to have access to income, should their future work hours change.Whole life insurance earns interest, typically at a rate of 4-6%, and is tax-deferred. Additionally, mutual insurance companies have historically paid out dividends for nearly 200 years. Both of these benefits increase the cash value of your policy. The cash value can be withdrawn at any time and used as additional income.

-

Ability to borrow against cash value:

Borrowing from the bank can subject you to rigorous credit and background checks. Policy loans from cash value life insurance are private and give you greater financial control. Use them to fund your business, pay college tuition and student loan debt, put a downpayment on a home, take a vacation… anything that supports your financial goals.When you take out a policy loan, the insurance carrier will charge you a low interest rate on your loan. Any amount left unpaid is deducted from your death benefit. However, regardless of the amount of the policy loan, you’ll continue to earn interest on the full cash value of your policy. Essentially every dollar of cash value does the job of two dollars.

-

Policy riders:

Women tend to live longer than men by about five years. When you have your own insurance policy, you can add riders like an Accelerated Death Benefit Rider, which will allow you to access your death benefit while you’re still living. You can use it to fund chronic or terminal medical expenses. With the right policy riders, whole life insurance for women becomes a highly customizable, unique product designed for your specific needs.At Paradigm Life, we structure whole life insurance policies for women with a Paid-Up Additions Rider, or PUA, which allows your policy to maximize its cash value in the shortest amount of time. Life insurance structured this way places more emphasis on cash value and the living benefits of the policy than on the death benefit, making whole life insurance for women a comparable option to a 401(k) or other qualified retirement plan.

-

Tax advantages:

Women might not make as much as their male counterparts, but they’re taxed the same. This is why the tax advantages of whole life insurance are especially appealing for females, including tax-free policy loans and tax-free retirement income. Money in your policy earns interest and dividends tax free, the growth of which can be used tax free. Additionally, whatever death benefit you pay out to your beneficiary—be it a person, a trust, or a charity—is also tax free, provided it doesn’t exceed the Federal Estate Tax Exemption rate.

Term vs. Whole Life for Women

Leaving a legacy for your children or loved ones is something many of us think about, but especially hits home for women. Call it maternal instinct, women want to know that everyone will be taken care of. Whole life insurance is one of the best products to ensure everyone is looked after, because it lasts for your entire life.

Many women, especially where income is tight, are drawn to the low cost of term life insurance. But benefit to benefit, women need whole life insurance to leave a legacy, guarantee income in retirement, and offer the financial foundation necessary to weather economic uncertainty. Term policies typically range from 10-30 years. If you don’t pass away in that time frame, your beneficiaries get nothing and you’ve wasted your money. Further, trying to take out an additional policy after your term insurance expires becomes increasingly more expensive due to age and health factors.

If whole life insurance or a first-to-die policy aren’t financially feasible, the next best thing is to take out a convertible term policy. With convertible term life insurance, you can at least get some coverage (although no living benefits are offered) for the time being. This guarantees your loved ones are taken care of if the worst should happen. Down the road when you’re more financially stable or have more disposable income, you may convert your policy to a whole life policy without taking a new medical exam.

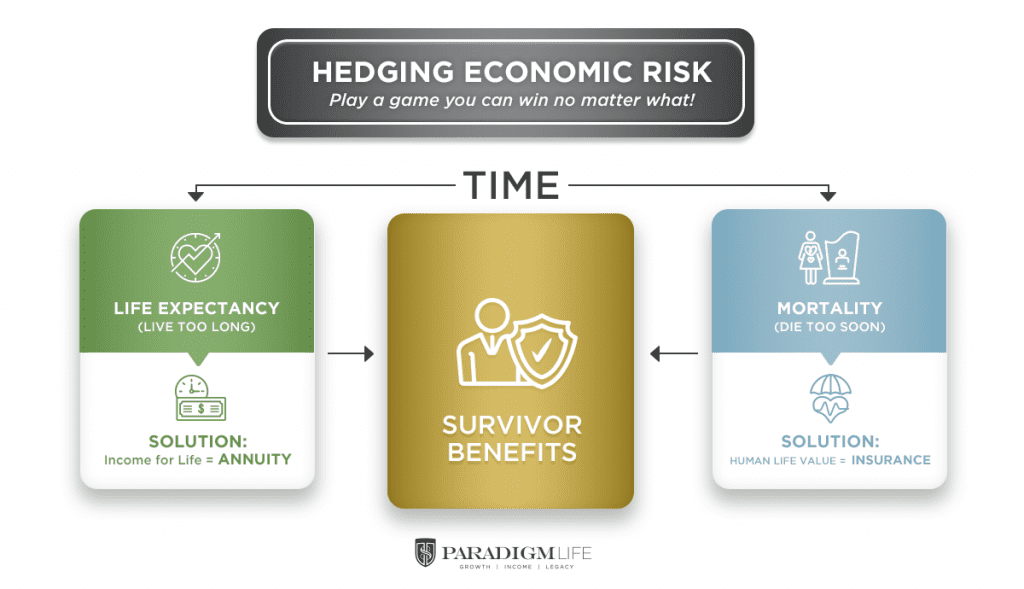

A Word On Annuities

If you have funds in a 401(k) or IRA currently and are worried about economic uncertainty wiping out your retirement savings, annuities can help hedge against market volatility and rebuild your wealth quickly. You can diversify your portfolio with both whole life insurance and an annuity. Diversifying with both is a great option if you have kids or are a primary caregiver, because the survivor benefits either way.

Even if you don’t have a beneficiary in mind, you can utilize the benefits of insurance while you’re alive and leave the death benefit to a trust or charity. (The other option is giving your hard-earned wealth back to the government, and what kind of legacy is that?!) Meanwhile, an annuity guarantees you won’t run out of money in retirement.

Our Wealth Strategists are experts at working with your budget and finding a policy that fits your needs. We work with the nations top mutual insurance companies to tailor your life insurance products to fit your financial goals.

Free Financial Education for Women

To truly maximize the benefits of whole life insurance for women, or any financial product or investment strategy, it’s important to be educated on what you’re purchasing and have a clear outline of your financial goals. There are a number of free resources to help women get the financial education they need to make sound money decisions that will have a positive impact toward financial freedom.

For more information about whole life insurance for women and how it fits into a broader financial strategy called The Perpetual Wealth Strategy™, Paradigm Life offers a free course called Perpetual Wealth 101®. In this eCourse, you’ll learn how to build a financial foundation, increase cash flow, and receive guaranteed income in retirement, as well as learn more about financing, interest, rate of return, and the stock market.

Inside the course, you can take the Financial Assessment to customize your learning based on your current financial knowledge. Plus, you can schedule a free consultation with a Wealth Strategist where you can ask questions specific to your financial needs and future goals.

In addition to Perpetual Wealth 101®, you can also take the Wealth Maximization Account® course completely free. This short video series dives deeper into the benefits of whole life insurance for women, covering these six topics:

- Certainty: A guaranteed rate of return takes the guesswork out of your portfolio.

- Control: Reduced tax liability and increased asset protection keep your wealth in your hands.

- Liquidity: Access your wealth when you need it, regardless of age, without penalties.

- Protection: Rest easy knowing market volatility can’t touch your financial foundation.

- Cash flow: Enjoy retirement income you don’t have to worry about outliving.

- Legacy: Pass along wealth the same way the Rockefellers have.

For more free financial education for women covering a wide range of topics, Clever Girl Finance offers a variety of resources, free courses, and a podcast covering everything from top personal finance books, tips for saving and budgeting, improving your credit score, ways to increase your income streams, and teaching kids about money, just to name a few.

Given that whole life insurance premiums are typically lower for women than for men, whole life insurance is one area of investment and finance where females can have an advantage. For more information on how you can use this proven wealth building strategy for your unique situation,  .

.