A passive income strategy is not always the easiest to come by. When hearing the term “passive income,” real estate or stock market investing are often the most common strategies that come to mind. However, generating a reliable passive income stream that isn’t subject to market fluctuations involves a proven strategy most people don’t know exists.

5 Misconceptions About Passive Income

You may have heard that a passive income strategy is necessary to become wealthy, key to finding financial freedom, and absolutely essential to an early retirement. While passive income can certainly help accomplish all three of these goals, there are falsehoods surrounding passive income strategies that can make wealth, financial freedom, and early retirement seem out of reach.

These are the most common misconceptions about passive income strategies:

MYTH: Generating passive income takes a lot of hard work.

FACT: A passive income strategy doesn’t have to be difficult, but does require some continued involvement on your part. Setting clear financial goals is crucial to making your wealth work for you.

By utilizing a proven tool for generating passive income (one that has been used successfully for nearly 200 years), you can increase liquidity and cash flow, as well as access tax-free wealth, without having to be a financial expert or business guru.

MYTH: You need multiple streams of passive income to grow your wealth.

FACT: While multiple passive income streams can help grow wealth, it’s also imperative to examine the risk involved with your investments. Income generated with stocks or other market-based investments are volatile.

One proven passive income strategy may be more beneficial than multiple volatile streams of income. In fact, the right strategy can even act as a volatility buffer, protecting you from future market downfalls.

MYTH: Real estate investing is a guaranteed way to earn passive income.

FACT: While many real estate properties appreciate in value over time, not all real estate investments generate wealth. Payments from renters may be a potential source of passive income, but only if you can reliably rent your property. Even then, overhead from maintenance and utilities, property taxes, and property management all eat away at your profits.

However, there is a proven passive income strategy that does come with multiple guarantees, including a guaranteed rate of return. This strategy also comes with a number of tax benefits, and can even be used as a cash source for real estate investments, if you decide you want to add real estate to your financial portfolio.

MYTH: You need a great business idea to generate passive income.

FACT: We’ve likely all been there—thinking if we could invent or conceptualize the next “big thing,” we would get rich. But not all passive income streams require an entrepreneurial spirit, nor do they require assuming unnecessary business risks.

There are a number of more conventional ways to generate passive income, including high-yield savings accounts and retirement accounts. There is also a product that can combine these two accounts in a single tool proven to generate passive income. And if you are a business owner or entrepreneur, it can even be used as a source of business capital.

MYTH: You need to invest a lot of money for a passive income strategy to succeed.

FACT: Passive income isn’t just a benefit for the wealthy. Provided you have a reliable source of income sufficient enough to cover your day-to-day expenses and are willing to put aside what extra you can to help grow your wealth, a passive income strategy is within reach.

At Paradigm Life, we’ve helped thousands of people, from millionaires to younger wage-earners, implement a personalized passive income strategy to help accomplish a myriad of financial goals, including accumulating tax-advantaged wealth, increasing liquidity and cash flow, enjoying early retirement, protecting valuable assets, and leaving a financial legacy that lasts generations.

The Perpetual Wealth Strategy™

There are many ways to earn a passive income, and while there really is no right or wrong way, there is a proven way that both puts you in control of your financial future and eliminates as much risk as possible.

This proven passive income strategy is called the Perpetual Wealth Strategy™, and it involves utilizing a financial tool you’ve likely heard of but almost certainly don’t fully understand—cash value whole life insurance.

For hundreds of years, individuals have used cash value life insurance in the form of whole life insurance as a way to protect and build their wealth. Whole life insurance is not like term insurance—you don’t just pay for a death benefit—you actually get numerous living benefits. One of whole life insurance’s unique qualities is that you can privately bank with it.

Because whole life insurance has a cash value that provides liquidity, individuals can finance high-ticket items, like a car or house, by borrowing against their whole life policy while simultaneously earning a rate of return. This strategy is a profound way to build wealth and allows you to capture the opportunity cost of your cash.

A key differentiator between the types of whole life insurance offered by most insurance companies and the type of insurance used to generate passive income is how a policy is structured. Most whole life policies earn cash value slowly and don’t optimize wealth in a way that offers the liquidity and cash flow needed to truly be considered passive income.

The whole life insurance policies utilized in the Perpetual Wealth Strategy™ are structured in such a way that they rapidly grow wealth and start generating passive income often in as little as 7 years, thanks to a feature called a paid-up additions rider. Additionally, these policies are underwritten by mutual insurance companies with a history of paying dividends on top of a guaranteed rate of return. We call these types of policies Wealth Maximization Accounts™.

The Wealth Maximization Account™

Imagine what you would want out of a passive income stream before you started to put a portion of your assets and earned income into it: a good return, liquidity, tax favorability, protection from creditors, guaranteed not to lose money… a Wealth Maximization Account™ with dividend-paying whole life insurance can offer all of these attributes and more.

Annual growth is contractually guaranteed. The cash value is liquid. Growth is free from income, dividend, or capital gains tax. Your account is private and typically not subject to the claims of creditors, and because it’s a permanent life insurance product, it includes a guaranteed death benefit that helps pass on a legacy for future generations.

Compared to passive income strategies like high-yield savings accounts, qualified retirement plans, or other market investment mutual funds, a Wealth Maximization Account™ generally outperforms when factoring in tax benefits and management costs.

How Whole Life Insurance Generates Passive Income

Whole life insurance policies are paid for with premiums, which remain level for the duration of the policy. The younger and healthier you are when you apply for life insurance, the more favorable rating you’ll receive from your insurer, which translates to lower premium payments for life.

A portion of each premium goes toward the death benefit and any associated fees; the rest goes toward the policy’s cash value account where it earns a guaranteed rate of return, plus potential dividends. (The top-rated insurance companies we work with at Paradigm Life have historically paid out dividends for over 100 years.)

When your whole life policy is structured for growth and utilizes a paid-up additions rider, you can essentially overfund your policy in the first several years to rapidly accumulate cash value. The growth of your policy is tax-advantaged and can be utilized tax-free in the form of policy loans.

Policy loans allow you to borrow your cash value, plus accumulated growth, from your whole life insurance policy while still earning interest and potential dividends on the full cash value of the policy. The growth of your cash value is your passive income.

Repaying your policy loan is typically in your best interest, as your insurance company will charge an interest rate, although you determine the payback schedule. The exception is using your whole life insurance policy to fund a tax-free retirement with passive income. Any unpaid loans will be deducted from your death benefit when you pass away.

Utilizing whole life insurance as a passive income strategy is much more than simply borrowing your own money. You’re gaining tax-free access to interest and dividends, which can amount to hundreds of thousands of dollars with a properly structured policy.

Your Whole Life Policy & Multiple Passive Income Streams

Robert Kiyosaki in his book, Rich Dad, Poor Dad states, “The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.” Kiyosaki goes onto expound about how powerful the mind is, “…if there is a problem, the mind (using its imagination), will come up with the solution.”

One of the wealthiest men in history, Cornelius Vanderbilt said, “I don’t care half so much about making money as I do about making my point, and coming out ahead.”

In context, what a very powerful and telling statement. Vanderbilt amassed one of the largest fortunes in history of $185 billion in today’s standards.

If those looking to build a passive income lived by the same passion of expression that Vanderbilt did, and trusted their imagination the way Robert Kiyosaki suggests, then there might be many more millionaires in this world, but the reality is many of us don’t truly know where our passions lie and rely on group-think instead of trusting our own minds.

Your Wealth Maximization Account™ can act as your financial cushion, allowing you the opportunity to get creative and find your passion to further increase your passive income. Many people use the available liquidity from their whole life insurance policy to support both their financial obligations, as well as other wealth-building interests, including personal improvement and education, investment real estate, hard money lending, and speculative investments.

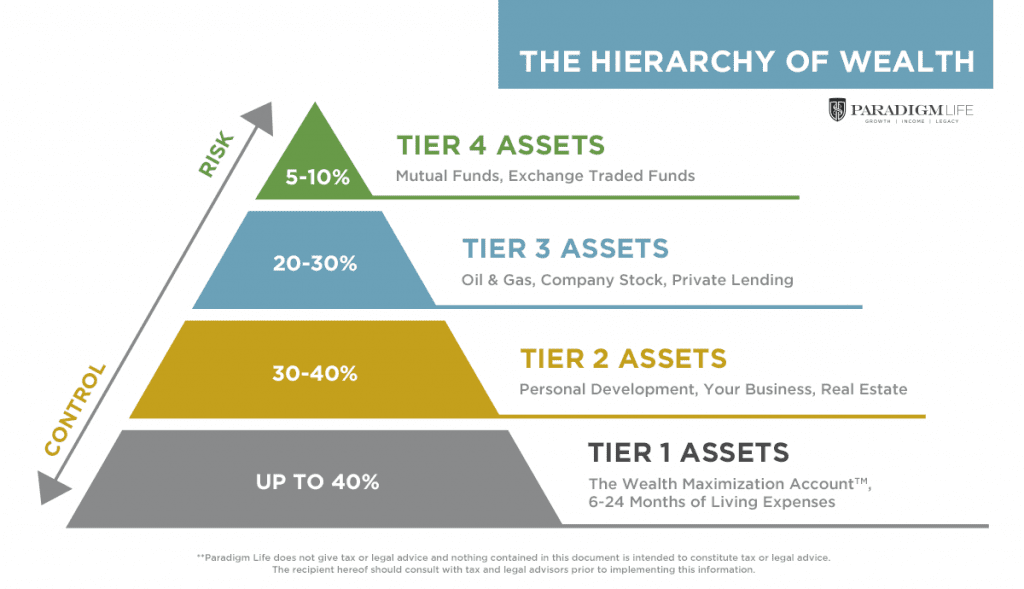

These additional sources of passive income are outlined in a diagram called the Hierarchy of Wealth, a system for classifying assets according to risk and control that delivers the highest benefit for each class (rate of return).

The Hierarchy of Wealth

Modeled after the famed psychological model, Maslow’s Hierarchy of Needs, developed by Abraham Maslow, the Hierarchy of Wealth is a crucial component of the Perpetual Wealth Strategy™ for passive income. Divided into 4 tiers, each escalates in level of risk while simultaneously decreasing in level of control, meaning the more risk you assume, the more external forces are at play when it comes to your cash flow.

Assets in this class are guaranteed, liquid, offer a prudent return, and maximize your control. Your Wealth Maximization Account™ is the primary asset here, functioning as your financial foundation by offering access to cash flow when you need it.

Assets in this class still offer a generous amount of control and should contribute to additional cash flow. Examples include investing in your personal development to make more money, investing in your business, or in hard assets like residential real estate that you own and control. Essentially, you’re investing in assets that can produce passive income you don’t have to work for.

Assets in this class rarely offer any guarantees or control. In fact, Tier 3 Assets and above generally require relinquishing asset control to a professional like a financial planner, money manager, or broker. Investing in Tier 3 Assets means assuming higher risk, however, it can result in higher returns. Examples include hard money lending against collateral, or syndicated funds for assets such as real estate or commodities.

Assets in this class offer no guarantees and come with the highest risk. They are considered speculative investments where you could lose 100% of your money and include stocks and other market-based investments.

The approach most people take with their money ends up looking like the opposite of the Hierarchy of Wealth—an inverted pyramid—where the riskiest assets have become their (unstable) financial foundation and funding assets that are the safest and most secure get put off, often until it’s too late.

When financial change comes, like a recession or market downturn, those with an inverted pyramid are wiped out, while those with a solid foundation in a Wealth Maximization Account™ are in a prime position to take advantage of opportunities that further grow their wealth.

No one sets out to generate passive income with the intent of losing money, but change happens. Your wealth will always be subject to volatility, economic disruption, failed partnerships, new trends, technology, etc. A Wealth Maximization Account™ with dividend-paying whole life insurance reduces, if not removes, these risks and creates a solid financial foundation with consistent passive income you can access at any time, for any reason.

Your Personalized Passive Income Strategy

Whole life insurance is a foundational asset that can assist you on your journey to financial freedom and finding a passive income stream—allowing the money to chase you, not the other way around.

If you’re ready to explore your personalized passive income strategy,  today. Your goals are our goals, and we’re here to help you every step of the way.

today. Your goals are our goals, and we’re here to help you every step of the way.