A Glance at The History of Life Insurance

Can you imagine living in a world where there wasn’t anything in place to protect you from a possible catastrophe? With such unpredictability in life,

Can you imagine living in a world where there wasn’t anything in place to protect you from a possible catastrophe? With such unpredictability in life,

In this episode of The Wealth Standard Radio, Host Ryan Lee talks with Agent Jennie Steed about the stock market, the life insurance industry, and

Whole Life Insurance and Term Life Insurance are two very different products, but many individuals categorize them as one and the same. When discussing the

“Any fool can make a fortune; it takes a man of brains to hold onto it,” Commodore Vanderbilt, Fortune’s Children: The Fall of the House

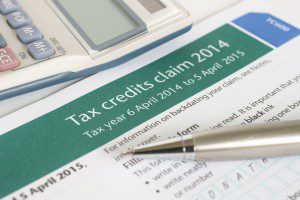

Remember the only two “sure things,” in life? One of them is lurking right around the corner; oh, yes, the tax man cometh, indeed. Before

Ironically, the one constant you can always count on in life, is change. Some change, like age or illness, you can’t control; other change, like

Patrick Donohoe, President and CEO of Paradigm Life is joined by special guest Scott Paul, Entrepreneur and founder of ArmorActive. In this episode of The

Just as buying a house may be the largest financial transaction you ever make, selling one might be the most profitable. Many individuals look to

A Rider is a provision of an insurance policy that is purchased separately from the basic policy which provides additional benefits, sometimes at an additional

The most important element to utilizing the Infinite Banking Concept with Whole Life Insurance is the Paid-Up Additions Rider, or PUAR. When adding this rider

“Between stimulus and response, there is a space. In that space is our power to choose our response. In our response lies our growth and

The role of life insurance for individuals and families have changed, and the demographic of policy holders has evolved. Previous generations grew accustomed to purchasing